When Hassan Rouhani ran for president in Iran’s 2013 elections, he was aware of the challenges facing him: economic growth had slipped below zero for the first time, inflation had risen to nearly 40 per cent, unemployment was high and growth in the production sectors was deteriorating. This deterioration was the outcome of disastrous economic policies under previous presidents, particularly Ahmadinejad, plus economic sanctions imposed on Iran by the UN Security Council (UNSC), the United States and Europe after nuclear negotiations reached a dead end in 2005. These sanctions were the main subject of the presidential campaign in Iran. Rouhani criticized Ahmadinejad and Saeed Jalili, then head of the Iranian negotiating team and one of the presidential candidates, for the way they had managed the negotiations and the resulting economic repercussions, saying that the Iranian economy should be moving ahead.

Hence, Rouhani’s presidential campaign hinged on ending the sanctions and improving the country’s economic situation. After winning the election, Rouhani brought in a staff with extensive economic experience under the previous governments of Mohammad Khatami and Hashemi Rafsanjani, both of whom had supported Rouhani’s campaign. By 2015, after less than two years in office, Rouhani had succeeded in reducing inflation from 40 per cent to 15.5 per cent and increasing economic growth to 3 per cent. However, unemployment remains high and inflation is still one of the highest in the region and the world. In addition, economic growth lags considerably behind population growth and the number of people joining the Iranian labour market.

The nuclear deal reached between Iran and the P5+1 countries on 14 July 2015, raised Iranian hopes of further economic improvements. However, Rouhani and his ministers know that changing the economic situation will require time and effort. They will also need to win over the opponents of change. In that regard, the administration will have to confront those who benefited from the sanctions (more than $30 billion during Ahmadinejad’s tenure) on the one hand and the powerful stakeholders in the old framework of Iran’s economy on the other. That being said, Rouhani’s speeches following the nuclear deal highlighted the implications of the deal for Iran’s economic future. The most important elements of those speeches are outlined below:

- Now that the sanctions have been lifted, Iran will not use financial returns – resulting from the release of frozen Iranian assets outside Iran and from the rise of Iran’s exports of oil and gas – to increase the amounts of imports. On the contrary, the government will for now stop further imports that are seen to be devastating national production.

- The government will not seek to appease the people through economic tranquilizers. Rather, the government aims to restructure its economic policies so as to achieve the following objectives: increase exports, reduce inflation to below 10 per cent, increase economic growth to 8 per cent and generally seek to achieve lasting economic recovery in favour of the people.

- The government aims to attract foreign investment and technologies, instead of importing products from abroad, so as to diversify the Iranian economy to benefit the people.

The Challenges to Rouhani’s Economic Programme

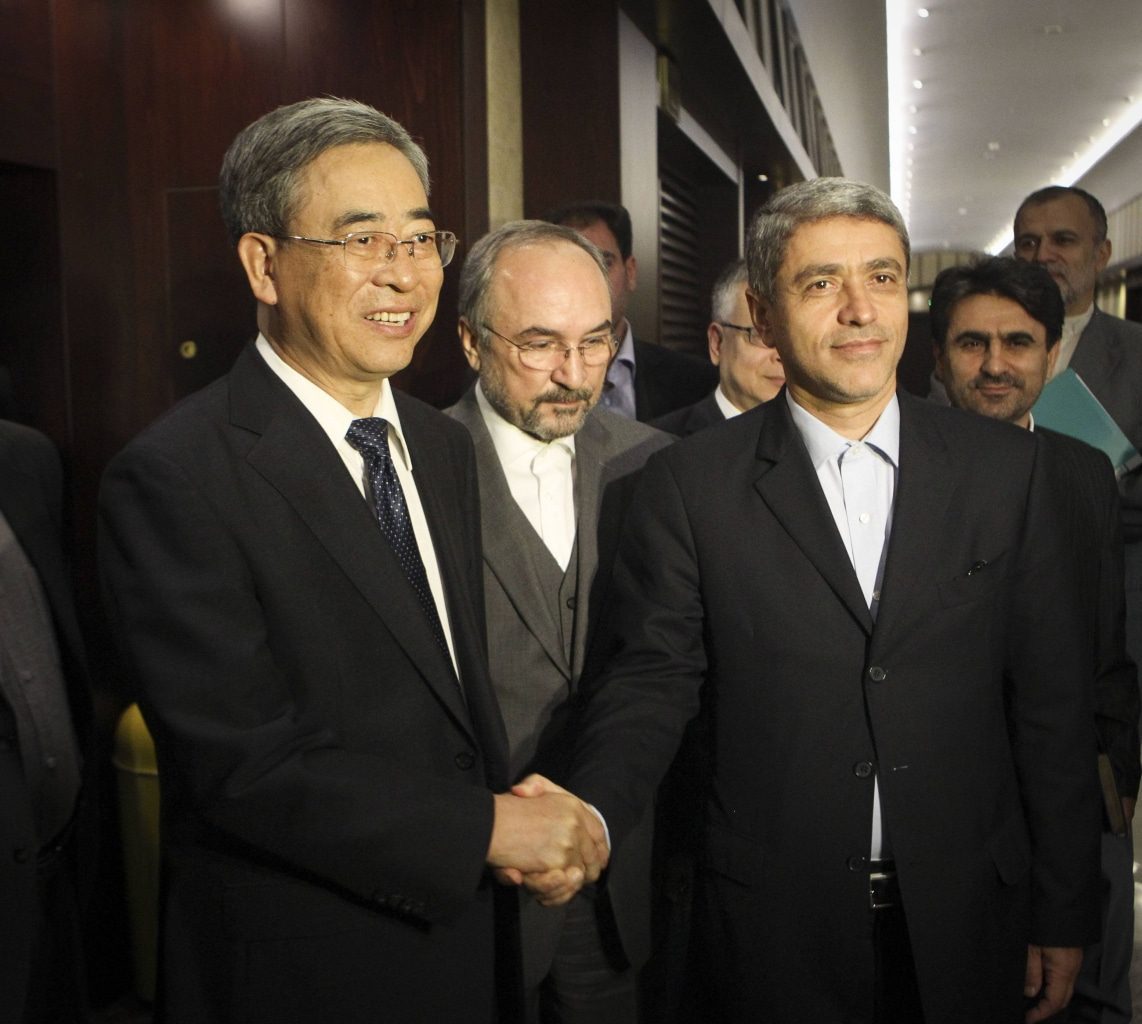

It is clear from these speeches that the Iranian government’s main concern is how to attract foreign investment as the Iranian economy needs considerable investment to improve the performance and quality of its production. With the growing number of visits by foreign economic delegations to Iran, the government has more clearly defined the goals set out above. Representatives from 100 French companies in several disciplines visited Iran in September 2015, for instance, although the visit only resulted in a handful of agricultural agreements. When the head of the Chinese State-Owned Assets Supervision and Administration Commission visited Iran, also in September, Tehran welcomed his offer of Chinese assistance in developing its manufacturing industries. Despite focusing on the announced objectives, the Iranian government knows how difficult the mission is, even beyond the conflict arising between Tehran’s wishes and the aspirations of foreign investors.

Energy is still Iran’s most attractive sector for foreign investment. While the government welcomes such investment and eagerly awaits the return of oil companies to Iran, a conference with oil investors was postponed four times, most recently until February 2016 (after the official lifting of UNSC sanctions). Iran is also seeking to attract investments in other sectors such as agriculture, services and non-oil industries.

Generally speaking, the Iranian government faces a number of issues in making progress in its economic priorities. These are:

- Reducing inflation and unemployment, given the structural changes that are required and weak foreign investment in sectors other than energy that could generate employment opportunities. Inflation reached a new high in 2015 after a two-year low, and needs to be lowered again in order to attract investments that anyway are not expected to be fully operational for months or even years.

- Treasury shortfalls. Six months into the Iranian fiscal year (March 2015-March 2016), Iran’s Vice-President Mohammad Bagher Nobakht announced that the government could not meet even half of its budget requirements for that fiscal year. In other words, the government is waiting for the expected increase in oil revenues and the release of Iranian balances frozen abroad to cover the huge deficit. Until that time, the government can do little to develop its manufacturing industries and tackle inflation and unemployment.

- The aspirations of foreign investors, which are different from those of Rouhani’s government. Energy companies appear the most eager to enter the Iranian market in the foreseeable future, which is at odds with the government’s hopes to attract investments in non-oil sectors.