Introduction

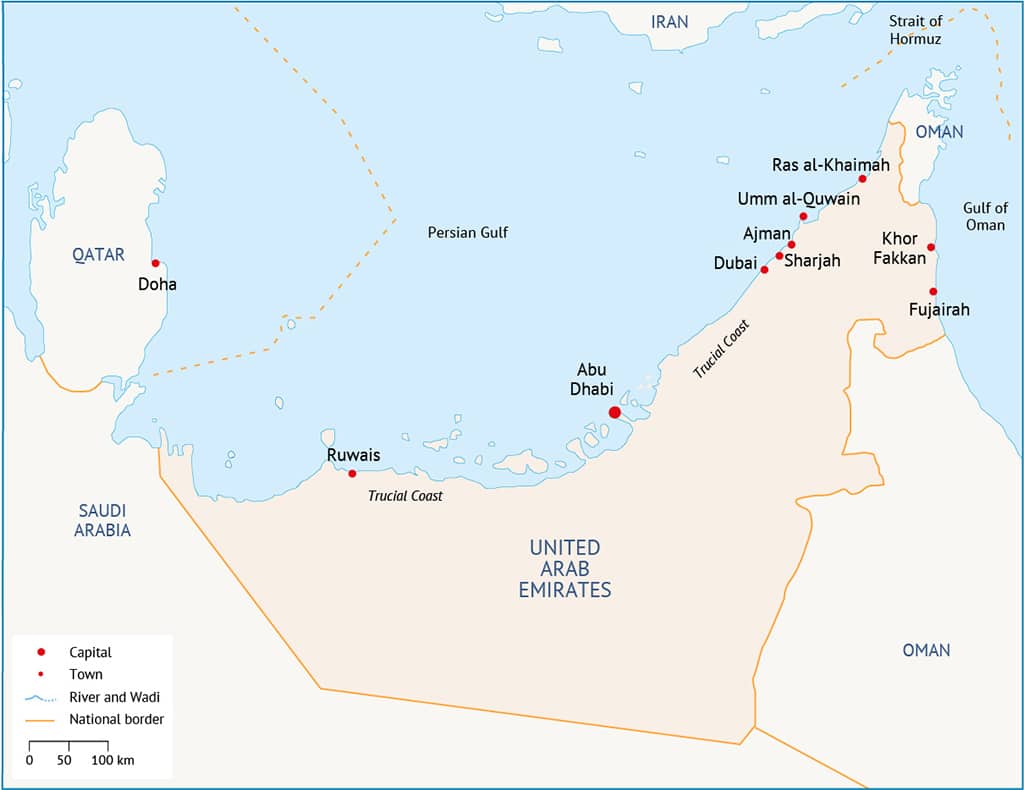

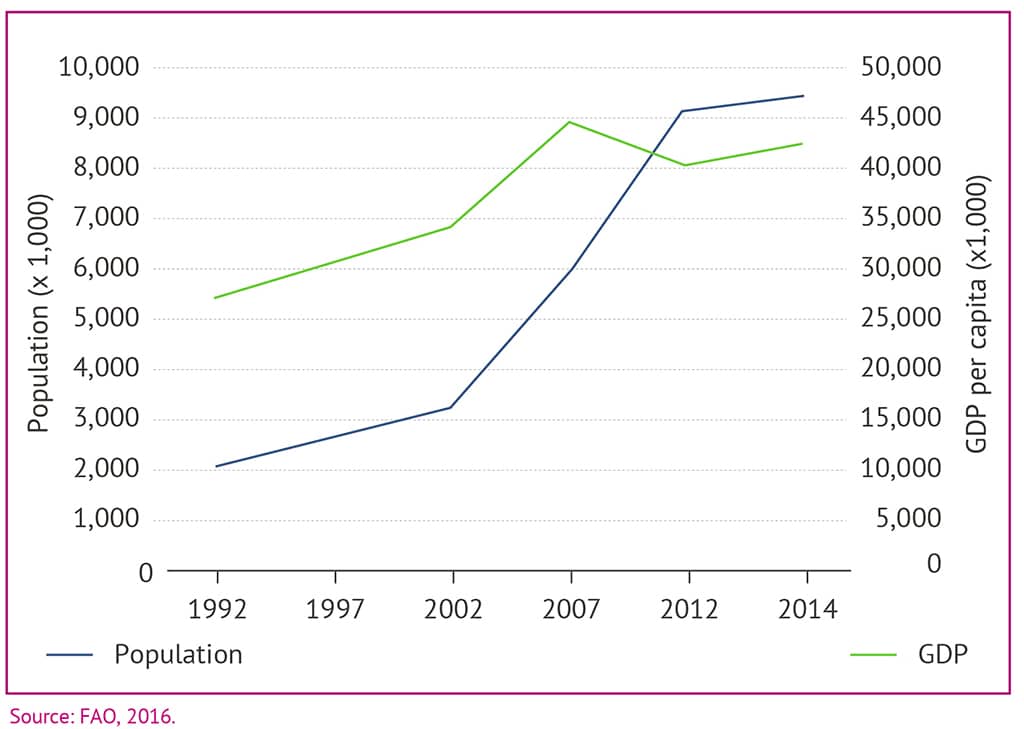

The United Arab Emirates (UAE) is a federation of seven monarchies known as emirates. These are Abu Dhabi, Ajman, Dubai, Sharjah, Ras al-Khaimah, Umm al-Quwain and al-Fujairah. Each is governed by an emir who has absolute power within his emirate, subject to the constraints of the constitution that governs the seven emirates’ relations with each other. One emir is chosen to be president of the federation; another is chosen to be its prime minister. Traditionally, these positions go to the emirs of Abu Dhabi and Dubai, respectively. There is a Federal National Council which has some legislative powers, but only half of its members are elected. The Federal Supreme Council, atop the executive branch, is composed of the leader of each emirate, with the leaders of Abu Dhabi and Dubai having veto power. Citizens of the UAE are a minority in the federation, at less than 20 per cent of the population, though the exact percentage has not been publicly disclosed in recent years. Expatriates represent about 85 per cent of the labour force.

The vast majority of the UAE’s oil and gas is found in Abu Dhabi (approximately 94 per cent); production of oil in Dubai has been declining for many years.1 The remaining five emirates in the east of the country are smaller and less wealthy.

Abu Dhabi comprises 87 per cent of the land area of the UAE, although Dubai has a larger population.

The UAE is a member of the Gulf Cooperation Council (GCC), a political and economic grouping of the six Arab countries that are on the Arabian Peninsula and have a coastline on the Persian Gulf. The UAE is also a member of OPEC and is its third-largest net oil exporter, as well as a member of the Gas Exporting Countries Forum (GECF).

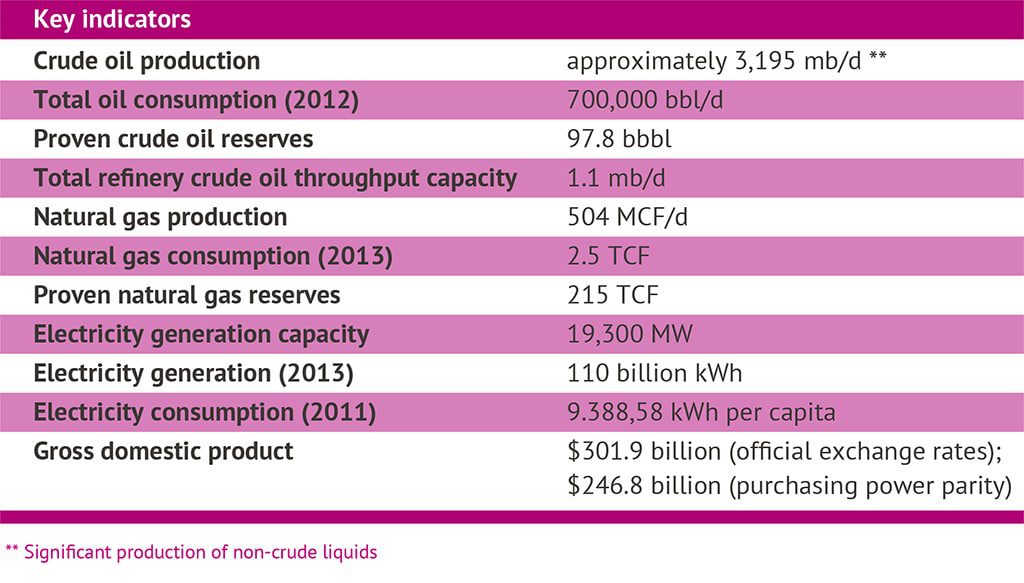

Overall, the UAE has the world’s seventh-largest proven crude oil reserves and is one of the world’s wealthiest countries per capita, particularly when considered only in terms of Emiratis. According to the International Monetary Fund (IMF), hydrocarbon exports generated $123 billion in 2013. It is unlikely that the UAE will make any major new oil discoveries. However, the application of enhanced oil recovery (EOR) techniques will help it to increase the extraction rates of its mature oilfields. According to the World Bank, the Emirati economy is becoming increasingly diversified, particularly in the city of Dubai, but oil and gas remain a mainstay of the economy, despite the country now being a net importer of natural gas.

The hydrocarbon economy makes up to 80 per cent of the government’s revenue. At 525 million British thermal units (BTU) per capita, the UAE has a high level of per capita energy consumption, a result of rapid economic development, energy-intensive industries and heavy use of air conditioning in a hot climate. The world per capita consumption of energy in 2011 was less than 80 million Btu. The country is the second- or third-largest energy consumer in the Arab world, and by some measures the highest per-capita contributor to greenhouse gases in the world. Almost 95 per cent of the country’s oil exports go to Asia, with the Japan taking the lion’s share. Oil currently makes up 58 per cent of the country’s economy. The government has adopted a strategy to reduce this to 36 per cent by 2030.

Oil

The UAE’s proven crude oil reserves have been assessed by Oil & Gas Journal at 97.8 billion barrels (bbbl) since 1997. The country is expected to maintain production at the current rates for at least the coming 80 years. Few new discoveries have been made in the past two decades, but the implementation of enhanced oil recovery (EOR) techniques has been able to maintain production capacity, and thus proven reserve levels from an economic recovery perspective. The UAE has state oil companies, but it has been fairly open to foreign investment that has brought the latest technology, although concessions are for the most part controlled by the state companies. Foreign producers are able to acquire their own equity hydrocarbons from the OPEC member, but in return they have to provide much of the investment for new production and to agree to margins that are reportedly very tight by international standards.

Because most of the Emirates’ oil and gas is produced in Abu Dhabi, the state oil company of that emirate, Abu Dhabi National Oil Company (ADNOC), is by far the most important in the country. Each emirate controls its own petroleum resources (although there is effectively revenue sharing between Abu Dhabi and the five poorer emirates). The Supreme Petroleum Council for Abu Dhabi (SPC) oversees ADNOC. The SPC sets Abu Dhabi’s petroleum-related policies and strategies. Considering Abu Dhabi’s dominant position in the UAE’s oil industry, the SPC is in fact the most powerful body in the country when it comes to oil policy making.

Dubai was once a relatively important producer, but production had declined to below 70,000 barrels per day (bbl/d) in 2016, compared to about 400,000bbl/d two decades ago. There was a discovery in Dubai in 2010, but this is expected to yield only an additional 10,000bbl/d of production. The Emirates National Oil Company (ENOC) runs the oil and gas sector in Dubai. Sharjah has always been a small producer – in 2016 production in that emirate was about 60,000bbl/d from the offshore Mubarek field.

ADNOC has a 60 per cent stake in the three consortia that produce most of the UAE’s crude oil:

The Abu Dhabi Company for Onshore Oil Operations (ADCO) has a capacity of 1.4 to 1.5 million barrels per day (mb/d). Its output is mainly from five fields: Asab, Bab, Bu Hasa, Sahil and Shah. All fields are linked to the storage and shipping facilities located at Jabel Dhana, where tankers load Murban crude for export. There were plans to expand capacity to 1.8mb/d by 2017, though the last consortium agreement expired in 2014. Other partners are BP (9.5 per cent); Royal Dutch Shell (9.5 per cent); Total (9.5 per cent); ExxonMobil (9.5 per cent); and Partex Oil and Gas (2 per cent). However, these plans were put on hold due to the low oil prices and thus capacity remains 1.4mb/d.

The Abu Dhabi Marine Operating Company (ADMA-OPCO) has a capacity of about 550,000bbl/d. Production (which also includes gas) comes from two major fields, Umm Shaif and Lower Zakum. Crude is transferred to Das Island for processing, storage and export. Other partners are BP (14.66 per cent); Total (13.33 per cent); and the Japanese Oil Development Co. (JODCO) (owned by INPEX) (12 per cent).

The Zakum Development Company (ZADCO) produces 640,000bbl/d. ZADCO was established in 1977 to develop and operate the Upper Zakum field, which the company ranks as the world’s fourth largest. It also operates the Umm al-Dalkh and Satah fields. Other partners are ExxonMobil (28 per cent), which took a stake in January 2006 as part of plans to boost output from Upper Zakum to 750,000bbl/d by 2010 from 500,000bbl/d; and JODCO (12 per cent). In July 2012, ZADCO awarded an $800 million engineering, procurement and construction contract to Abu Dhabi’s National Petroleum Construction Company, with the objective of expanding oil production at the Upper Zakum field to 750,000bbl/d by 2016.

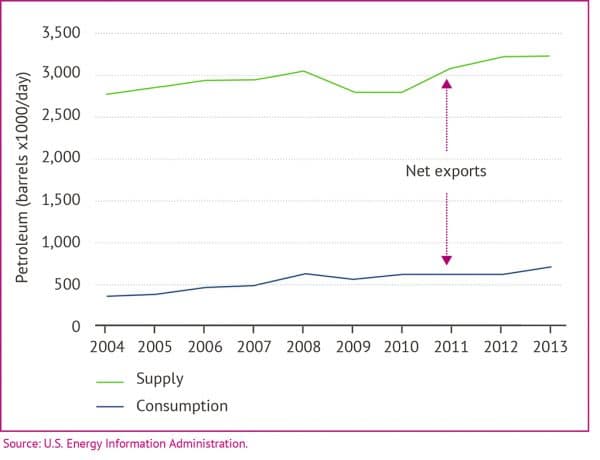

In 2014, the country produced an average of 3.5mb/d, of which 2.7mb/d was crude oil and the remainder was non-crude liquids such as natural gas plant liquids and refinery processing gain. This made the UAE the second-largest producer in OPEC after Saudi Arabia and fourth-largest crude oil producer in OPEC after Saudi Arabia, Iraq and Iran. The increase in capacity is attributed to a number of new projects that have come online, including expansion of Umm Shaif, the Lower and Upper Zakum fields plus other EOR schemes. Furthermore, the country plans to increase crude oil production by 800,000bbl/d to 3.5mb/d in 2020. However, the UAE is currently reducing output following the OPEC decision to cut production in November 2016.

As mentioned above, the UAE Emirates has a high level of per capita consumption, but given the relatively small population, the country is a major exporter in the world market and in OPEC – it is the world’s fourth-largest net exporter. Net exports have remained in excess of 2mb/d. The country has attempted to reduce consumption in recent years by switching to natural gas-fired electric generation, and, although still not significant, investing in renewables. The large refining sector also means that it exports refined products in addition to crude oil. According to the Oil and Gas Journal, the UAE had a 773,250bbl/d refining capacity at five facilities as of January 2011. The two largest refineries – Ruwais and Umm al-Nar – are in Abu Dhabi, with capacities of 350,000bbl/d and 150,000bbl/d respectively. The third notable refinery is the 120,000bbl/d Jebel Ali facility, located in Dubai and operated by ENOC.

The UAE has numerous export terminals, but of interest are the Emirates’ efforts to expand export capacity in Fujairah, on the Gulf of Oman. Such exports avoid having to be taken by tanker through the Strait of Hormuz. Given the political tensions relating to Iran, as well as already high tanker traffic, the value of avoiding the strait has increased. In 2006, the UAE decided to construct a new pipeline, called the Habshan-Fujairah Pipeline or the Abu Dhabi Crude Oil Pipeline (ADCOP). This pipeline was inaugurated on 15 July 2012, when it made its first delivery of Murban crude to Pak-Arab Refinery. The pipeline will allow 1.5mb/d of Emirati exports to flow directly to the Fujairah export terminal.

This expansion will also enable the UAE to expand its storage capabilities significantly in the coming decade. In 2015, a new storage terminal in Fujairah was opened enabling the country to hold almost 16 million barrels of crude oil and petroleum products. In addition, the country plans to expand the terminal to include three subsea loading lines, an intermediate pumping station and three offshore buoys designed for deep-water tanker loading. In addition, the UAE is constructing a refinery for 200,000bbl/d, aiming to expand both local supply and export by 2020. This plan aims to make Fujairah a critical connection in the global refining and export network.

In addition, the UAE and Oman are planning to build a jointly operated refinery in Duqm Special Economic Zone. This plant is planned to have a capacity of 230,000bbl/d by 2018. Recently, the Dubai Supreme Council of Energy (DSCE) signed a memorandum of understanding with China’s Sonangol to build a refinery in Dubai. No information on capacity and completion has yet been made public.

Natural Gas

By global standards, the UAE has large natural gas reserves, although smaller than those of neighbouring Iran, Qatar and Saudi Arabia. The UAE’s conventional proven dry natural gas reserves are generally considered the seventh largest in the world, at 6,453 trillion cubic metres (TCM). This estimate, for 2011, is a 6 per cent increase on the previous year’s estimate, reflecting intensified exploration and utilization of enhanced recovery techniques. Despite having vast reserves, the UAE became a net importer in 2010, as local demand grew faster than reserves could be developed. By 2014, the country was consuming 69.3BCM of natural gas, making it the ninth largest natural gas consumer in the world. Many reserves are associated (part of a mixed oil and gas field) and are used for reinjection to enhance oil output. Gross imports of natural gas into the UAE are even larger than net imports, as Das Island in Abu Dhabi has a three-train liquefied natural gas (LNG) export terminal dating from when natural gas was relatively more plentiful in the federation (and region).

Production of onshore natural gas (and natural gas liquids) in Abu Dhabi is mainly conducted through the Abu Dhabi Gas Industries Limited (GASCO) consortium, consisting of ADNOC (68 per cent); Shell (15 per cent); Total (15 per cent); and Partex (2 per cent). Among GASCO’s most important fields are Asab, Habshan-Bab, BuHasa and Ruwais. Another important project is ADNOC’s $10 billion project with Occidental Petroleum, which is aimed at monetizing the sulphur-rich gas of the Shah field, located along the UAE’s border with Saudi Arabia. The gas contains around 30 per cent hydrogen sulphide, making Shah much more challenging to develop than a conventional deposit. The field will have the capacity to produce 10.34BCM of gas annually, in addition to 50,000bbl/d of condensates, 4,400 tons per day (t/d) of natural gas liquids and 10,000t/d of sulphur.

According to the World Energy Council, the UAE’s dry natural gas production was estimated in 2014 at about 55BCM per year, which is equivalent to 5.8 per cent growth year-on-year. Although dry gas production is expected to increase to 62BCM by 2015, this is still far below the reserve potential of the country. There are plans to develop the Bab gas field, which could potentially add similar amounts of gas as the Shah project. It is 150km south of Abu Dhabi and is the largest onshore field in the UAE based on total area. This project has faced several challenges since Royal Dutch Shell decided to exit it in 2016 due technical challenges and costs. In 2016, ADNOC went in search of other investors since energy companies are struggling to respond to the collapse of the oil prices.

The country is dealing with the demand by expanding production, switching to carbon dioxide for field injection pressure instead of methane reinjection, increasing natural gas prices (closer to world market prices), developing non-fossil fuel sources of power and, of course, importing natural gas. Qatar is the source of the UAE’s gas imports, mostly via the Dolphin Pipeline. The pipeline began supplying gas to the UAE in February 2008, at a rate of 2 billion cubic feet (BCF) per day (20.7BCM per year). The pipeline also delivers a smaller amount of gas onward to Oman. In 2016, the agreement was to supply additional gas to Sharjah.

In 2010, for the first time ever, the UAE took delivery of LNG at a floating terminal in Dubai. The contracted LNG import amount is 0.16BCM (re-gasified) per year, whereas the export capacity at the Das Terminal is 5.15 million tons per year – current contracts indicate the export of slightly less than 8BCM/yr (re-gasified). Most LNG exports are contracted to go to Japan.

The UAE has attempted to import gas from Iran, but after reaching an agreement between Dana Gas and the Iranian National Oil Company for a 25-year deal for 5BCM/yr in 2001, the Iranians later demanded a higher price, and Dana Gas decided to seek international arbitration, which is still ongoing. This dispute has also affected the plans of Oman, which initially wanted to extend the Iran-UAE pipeline to Oman but is now planning a direct Iran-Oman gas pipeline.

Electricity

The UAE had an installed generation capacity of about 19.3 gigawatts at the end of 2010. This is virtually all thermal power, with gas-fired power (85 per cent of the total) having replaced oil as the primary generating fuel in the past decade. Generation in 2014 was 102,7 billion kilowatt hours (kWh), with an average increase of ca. 8 per cent annually. In 2016, 98 per cent of the UAE’s power plants were fired by natural gas and the remaining 2 per cent by liquid fuels.

As of 2014, the UAE’s net energy consumption was 85.17 terawatt hours (TWh). Energy use has always been high due to the arid desert climate that brings high temperatures and extremely high humidity. More than 65%of the energy consumption fulfils two major demands: water provision and cooling (i.e. air-conditioning). The rapid population increase in recent decades combined with diversification of the economy has resulted in soaring GDP growth, rising living standards, urbanization and thus more energy consumption.

This has made the UAE one of the highest per capita carbon emitters in the world. In fact, its per capita carbon emission load has been estimated as twice that of a typical developed country. The Emirates News Agency reported in 2013 that electricity demand in the UAE would grow by 50 per cent by 2020.

The UAE’s Energy Mix Challenge

Besides increasing production and/or import of natural gas and expanding gas-fired power, the Emirates has looked at several alternatives to thermal power. Coal-fired power has also been considered, but there are no plans to go forward with a coal-fired plant. One option is nuclear power, and despite the political complications of developing nuclear power in the region, the UAE has continued with its efforts to develop its nuclear power capability. Avoiding any concerns about the peaceful nature of its ambitions, UAE applied and received approval from the International Atomic Energy Agency (IAEA) for its nuclear projects. In November 2013, the Dubai Electricity and Water Authority (DEWA) announced that it aims to have 12 per cent of its electricity supply capacity from nuclear by 2030.

The state-owned Emirates Nuclear Energy Corporation (ENEC) is the lead actor in organizing the sector, and in 2009 it awarded a $20 billion contract to a South Korean consortium to build four nuclear plants with a combined capacity of 5,600 megawatts (MW). In 2016, an operating company, Nawah Energy Company, was created to operate and maintain the four Barakah units, with 82 per cent ENEC equity and 18 per cent KEPCO. The first APR-1400 units, Shin-Kori 3&4, are under construction in South Korea, and one is already in operation. By 2020, the UAE aims to have four of the 1,400MW nuclear units running and producing 25 per cent of its electricity at a quarter of the cost of gas. It plans to export electricity to GCC countries via the regional power grid.

In October 2016, ENEC and KEPCO concluded a joint venture partnership agreement establishing the Barakah One PJSC, an independent jointly-owned subsidiary (KEPCO 18 per cent).

In addition, in order to respond to the carbon emissions challenge, the UAE has adopted several energy and climate-change-related policies and initiatives. The main purpose is to reduce the overall dependency of the UAE on fossil fuels by deploying renewable energy, nuclear energy and adopting energy-efficiency measures.

The country has a great deal of potential for solar power and the government of Abu Dhabi aims to generate 7 per cent of power from renewable sources by 2020, which will be met by solar and waste-to-energy projects. According to the Renewable Energy Development Strategy, Dubai has a target of 7 per cent from clean energy sources by 2020, rising to 25 per cent by 2030 and 75 per cent by 2050. Total installed solar capacity reached 133MW in 2015.

The key renewable energy projects in the UAE are:

Masdar City

Masdar City is a planned city project that runs completely on renewable energy and was designed to host hi-tech companies, including the International Renewable Energy Agency (IRENA) that is also headquartered in Abu Dhabi. Masdar City will be the world’s first carbon-neutral city running on solar. However, this ambitious project is currently facing implementation challenges as many investors are pulling out.

Shams 1 and Shams 2

Opened in 2013, this is a concentrating solar power station project located 120km from Abu Dhabi in Madinat Zayed. The project was developed by Masdar City in a joint venture with Spain’s Abengoa Solar and France’s Total. It is so far the largest solar project in the MENA region. This project currently generates 100MW, with plans to increase this to 2,000MW in the future. Project-specific tariffs were established by the Regulation and Supervision Bureau (RSB), following competitive international tendering.

Dubai Solar Power Plant

DEWA is implementing a number of solar projects ranging in capacity from 10 to 100MW. The plants will use either photovoltaic (PV) or thermal solar technologies. So far, 13MW of solar PV in Dubai were commissioned at the first phase of the total 1,000MW Mohamed bin Rashid al-Maktoum Solar Park. Dubai also commercialized water heating from solar thermal collectors, which are mostly used in large installations such as hotels and new buildings.

In addition, the UAE has a total of more than 10MW of rooftop solar PV across the country, with plans for expansion. The UAE is also looking at solar power for desalination, and in 2014 approved four pilot projects that use highly energy-efficient membrane technologies to generate more than 1,500cm/d of water.

Geothermal

Masdar City is currently negotiating with the Icelandic company Reykjavik Geothermal to build the first geothermal energy facility in the GCC. It will produce 5MW that will be used for air conditioning.

Hydrogen Power Abu Dhabi (HPAD)

HPAD is a joint venture between Masdar City (60 per cent) and BP (40 per cent) to build the first commercial-scale hydrogen-fuelled power plant using fossil fuel feedstock and carbon capture and storage. This 400MW project will take natural gas from the grid and convert it to hydrogen and CO2. Once implemented, it will provide more than 5 per cent of Abu Dhabi’s current power generation mix.

A detailed list of the UAE’s renewable energy initiatives is listed here.

In addition, the UAE has decided to invest in various renewable energy projects domestically, in the MENA region and around the world. The UAE is also providing funding for renewable energy projects to the IRENA.

Energy Sector Structure and Organization

The electricity sector is organized differently in each of the seven Emirates and consists of local authorities/regulators, government-owned companies, private sector stakeholders and semi-private entities. However, both the water and electricity supply chain consists of overarching regulatory authorities. The four largest utility authorities are as follows:

Abu Dhabi Water and Electricity Authority (ADWEA)

Dubai Electricity and Water Authority (DEWA)

Sharjah Electricity and Water Authority (SEWA)

Fujairah Electricity and Water Authority (FEWA). FEWA is responsible not only for Fujairah but also for the emirates of Ajman, Umm al-Quwain and Ras al-Khaimah.

All four utilities are connected and known collectively as the Emirates National Grid (ENG). In practical terms, ADWEA has signed agreements with DEWA, SEWA and FEWA to export power from Abu Dhabi to the other emirates. The ENG is also connected to the other GCC countries through a regional agreement system.

The electricity sector in Abu Dhabi was unbundled in 1999 with the creation of ADWEA and the Abu Dhabi Transmission and Dispatch Company (TRANSCO) ; the Abu Dhabi Distribution Company and al-Ain Distribution Company. The companies are all 100 per cent government owned. However, the UAE has also adopted a public-private approach by entering into joint ventures between ADWEA and foreign investors such as independent water and power producers (IWPPs) and generation and desalination systems (GDs). Ownership is divided 60-40 between the two stakeholders and power will be sold to ADWEA through power purchase agreements for 20 years. ADWEA and each of the project’s companies are regulated by the Regulation and Supervision Bureau (RSB).