Introduction

Algeria, with an economy reliant on hydrocarbon exports, ranked 11th in the world in 2021 in terms of estimated natural gas reserves of about 159 trillion cubic feet. Algeria also has about 12.2 billion barrels of proven oil reserves.

In its first year, the coronavirus pandemic severely affected Algeria’s economy. Besides the impact on health, the pandemic had other negative repercussions, including the decline in oil prices and the Algerian economy falling into a recession; real GDP contracted by 5.1 per cent in 2020, while the growth rate declined by 6.1 per cent compared to 2019, according to World Bank data.

According to the African Development Bank, the measures taken by the Algerian government to contain the spread of COVID-19 have had dire consequences for the services and construction sectors, particularly with regard to job losses. The decline in revenues from oil and gas exports also widened the public and foreign deficits.

According to the African Development Bank’s Economic Outlook report, the effects of government measures included “the public budget deficit more than doubling in 2020 to 13.6 per cent of GDP from 5.6 per cent in 2019, due to the combined pressure from the decline in hydrocarbon revenues, which constitute a significant portion of public revenues, and higher public spending to mitigate the effects of health on the economy.”

The report added that “the current account deficit also widened to 148 per cent of GDP in 2020 from 10 per cent in 2019 due to the country’s heavy reliance on hydrocarbon exports and high import volumes. Consequently, the level of foreign exchange reserves gradually decreased to barely enough to cover just 12 months of imports at the end of 2020, compared to 13.6 months at the end of 2019.”

“The Bank of Algeria sharply reduced the reserve ratio to 3 per cent in September 2020 from 12 per cent in February 2019 in order to provide banks with additional liquidity to finance the economy,” the report said.

According to the International Monetary Fund (IMF), Algeria’s outlook remains fraught with a great deal of uncertainty. However, the country’s economy has begun to gradually recover from the initial effects of the COVID-19 pandemic. This holds true whether in terms of recovery from the effects of the oil price shock in 2020 and the exacerbation of long-term economic imbalances, or rising government debt and falling international reserves. The health crisis has abated, and most pandemic containment measures have been lifted. Meanwhile, with the recovery of hydrocarbon production and prices, Algeria’s economic growth is back on track.

Gross Domestic Product

The coronavirus pandemic led to a recession in the Algerian economy in 2020, as Gross Domestic Product (GDP) growth fell by 6.1 per cent in 2020 compared to 2019, according to World Bank data. The average GDP growth rate in Algeria reached 1.81 per cent between 2010 and 2020, reaching its highest level of 3.8 per cent in 2014, and its lowest level in 2020 when the country’s economy recorded a major contraction (negative growth) of 5.1 per cent after five consecutive years of a continuous slowdown.

The repercussions of the pandemic were reflected in the performance of the non-oil sector due to shutdowns in economic activities. In addition, the economy witnessed a decrease in oil output levels due to lower demand and Algeria’s commitment to the “OPEC+” agreement to reduce production volumes. This resulted in a 12 per cent drop in crude production levels in 2020, as output fell from 1.022 million barrels per day in 2019 to 897,000 barrels per day in 2020.

The double shock caused by the strict preventative measures to contain the pandemic during 2020 and the sharp decline in hydrocarbon revenues exacerbated the economic difficulties experienced by Algeria.

Labour-intensive sectors, such as services and construction – which are significantly concentrated in the informal economy – were severely affected, resulting in many jobs being lost temporarily or permanently. Simultaneously, the temporary decline in oil prices, along with the decrease in export volumes, caused a sharp drop in hydrocarbon export earnings. While the Algerian economy showed signs of recovery during the second half of 2020, companies and workers remained severely affected by the economic stagnation. According to the World Bank, “the temporary decline in world oil prices further deteriorated the fiscal balance, bank liquidity and foreign transaction balances, despite the decline in the value of the Algerian dinar.”

Industry

The oil and natural gas sector has historically dominated Algerian industry. On the one hand, the oil and gas sector is the largest industrial sector in the country. On the other hand, however, the revenues generated from the export of oil, gas and related products have been the main source of investment capital for other industries, in addition to the huge loans from the international capital market which represented a mortgage on these reserves.

Oil and natural gas are typically transported from the most important production sites in the Sahara to the Mediterranean coast. The industrial areas surrounding major cities, such as Algiers, Oran and Annaba, are home to large refineries, petrochemical complexes, and plants to liquefy natural gas, which is subsequently transported by tanker to foreign markets.

As the main body responsible for the oil and gas sector, the national oil company Sonatrach – the national company for research, production, transport, transformation and marketing of hydrocarbons – is often considered a state within a state. After the company was established in 1963, it grew in size and importance with the nationalisation of foreign interests in the oil sector within one decade.

Algeria was classified by the International Energy Agency as having one of the world’s three largest reserves of shale gas in 2018, according to Arabi21.

Sonatrach has also gained international prestige with contributions and partnerships, as well as 41 international branches in 2019, which will enhance its presence and strengthen its financial position.

The company operates across the entire hydrocarbon value chain, integrating five activities: exploration and production; pipeline transportation; liquefaction and separation; refining and petrochemicals; and marketing. The consolidated turnover of the company for the 2019 fiscal year was estimated at 5.538 trillion Algerian dinars ($46 billion). However, oil companies incurred significant losses in 2020, estimated at 40 per cent of their income, and thus reduced their investments by 32 per cent. Sonatrach was not immune to these effects.

In 2020, Algeria saw a sharp decline in oil and gas production from fossil sources, while domestic demand for gas and petroleum products increased by an estimated 7 per cent. This curtailed opportunities to export output from these sources to international markets.

On this basis, Algeria has approved an energy transition programme aimed at promoting the use of renewable energies and avoiding energy deficits. According to the current “laissez-faire scenario” in terms of production and consumption, by 2030 Algeria may turn into a country that is unable to export, and by 2040 become an energy-importing country.

In the 1970s, Algeria’s government invested billions in oil money (in addition to loans from international markets) in establishing heavy industries – particularly the steel industry – fueled with Algerian iron ore. Along with other basic industries (such as cement plants), the steel mills were intended to be a base for intensive industrial development and to provide income for light industries that produce consumer goods. The “factory industrialisation” approach failed to achieve the intended results, in part due to the political factors inherent in the rentier economy. A large number of factories remained ineffective, and appeared as job generators for the regime’s workers, managers and bureaucracies in the ministries affiliated with it.

With dwindling resources and rising foreign debt, the process of restructuring the industrial sector and privatising part of it appeared to become a matter of urgency, and a large number of state companies were split up in the 1980s. A decade later, the focus shifted to the policy of attracting foreign investment in Algeria’s industrial sectors. This policy was not pursued to its full extent, as some activities were still considered to be of strategic importance to the state. More importantly, the structural deficit and inefficiency that plagued a large number of firms in the public sector at the time discouraged foreign firms from investing in the country, much as the civil war did.

After 1999, the seeming stability of the political and security situation and the beginning of a new era of rising oil and gas revenues, began to change this picture. As a result, the symbolic steel complex of El Hajjar became the property of the Indian group ArcelorMittal. The increasing opportunities for foreign investment in French carmaker Renault also led to the production of cars in Algeria. Negotiations and other arrangements progressed slowly, but the fact that two-thirds of Algerian cars were manufactured in France provided sufficient motivation to continue the work.

Algerian light industries are more diversified, and have always included large private companies. With regard to heavy industries, the majority of factories are located near the main urban centres in the north, although the decentralisation in the 1980s led to the establishment of more light industries in the densely populated high plateaus and some oasis cities. The light industry sector includes the manufacture of food, household appliances and some luxury goods, although in many cases consumers prefer imported goods that afford them a higher social status.

There were a total of 97,803 small and medium-sized industrial companies in Algeria until mid-2018 of which 99.92 per cent were owned by the private sector. The percentage of workers in the industrial sector decreased from 30.91 per cent of the total number of employees in 2018, to 30.42 per cent in 2019, according to World Bank data.

Agriculture and Livestock

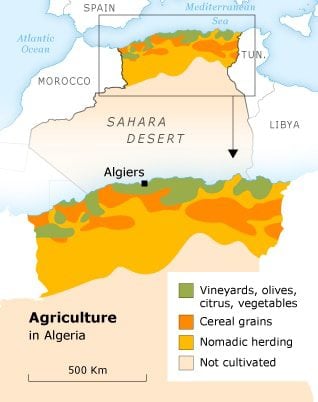

Farming

Algeria’s agricultural sector is considered the backbone of national economic development as it increases gross domestic production and raises its per capita share, in addition to providing jobs and improving the living standards in the countryside. This is thanks to significant natural, human and material capacities, which were cultivated within the framework of successive development programmes.

Studies have shown an increase in various agricultural products and their diversity, as well as in the role that agriculture plays in the national economy, which is limited compared to the sector’s capabilities and dependable results in the planned development programmes.

By the beginning of the 21st century, grain products occupied a strategic place in the Algerian national diet and economy. Until 2017, grains occupied some 40 per cent of the arable agricultural area.

In 2020, the agricultural sector, in contrast to most other economic sectors that were severely affected by the repercussions of the prevailing COVID-19 health crisis, appeared to display great capacity to withstand the effects of the crisis. Furthermore, it witnessed a great leap in production and recorded an export surplus. Consequently, Algeria’s exports of agricultural products saw a significant jump in 2020, with more than 100,000 tons exported, compared to 70,000 tons in 2019. Sky News Arabia, citing official sources, reported that Algeria was able to export 50,000 tons of agricultural products during the first quarter of 2021.

According to estimates reported by the Algerian News Agency, agricultural production contributed more than $25 billion to the country’s GDP at the height of the health crisis that characterised the year 2020, compared to $23 billion in 2019.

Thanks to its human, natural and material resources (mechanisation), agriculture has established itself as a strategic sector capable of ensuring food security for the country even in the most difficult circumstances.

2020 was also marked by the promotion of the judicious use of natural resources and water, and the fight against waste via the tight management of surplus production, especially through the sector’s determination to develop the logistical chain (storage, refrigeration and transportation).

To this end, the sector announced a road map to organise production according to the specificities of each region with the establishment of units for the food processing industries.

In the year 2020, more than 11.5 million trees were planted within the framework of the National Reforestation Programme.

An average of about 3.4 million hectares were planted with grains during the second decade of the century, an increase of 6 per cent over the average during the previous decade. Durum wheat and barley occupy about 74 per cent of the total grain area.

The rate of grain production during the second decade of the century is estimated at 51.5 million kantars (a kantar is a unit for grain volumes and is equivalent to 143 kg), an increase of 57.8 per cent compared to the previous decade when the production rate was estimated at 32.6 million kantars.

Durum wheat and barley constitute about 80 per cent of the total grain production, at 51 per cent, and 29 per cent, respectively.

The contribution of the agricultural sector to the GDP amounted to more than 12.4 per cent, with a production value equal to $25 billion in 2020, compared to $23 billion in 2019, and with the sector employing more than 2.5 million workers.

According to official agricultural sources, Algeria exported 50,000 tons of agricultural products during the first quarter of 2021. To encourage investment in agriculture, the Algerian government announced its intention to support investments in the sector, with support of up to 90 per cent of the value of the investment project.

Algeria ranked first in Africa in terms of food security, according to the classification of the United Nations World Food Programme. This achievement placed Algeria in the “blue box,” at the same level as the most advanced countries in the world. The report ranked Algeria among the food-stable countries, placing the country in the category of countries in which less than 2.5 per cent of the total population suffer from malnutrition during the period between 2018-2020.

Economic and agricultural experts believe there are numerous considerations behind Algeria’s positive classification in the country’s move to bridge the food gap given its great economic potential, in addition to the shift towards interest in agriculture and food industries in the context of moving away from its reliance on hydrocarbon exports.

Livestock

Five main types of livestock are raised in Algeria: cows, sheep, goats, camels and horses. Between 2019 and 2020, the numbers of livestock were estimated at 28 million sheep, 1 million cows and 400,000 camels. The number of sheep increased by more than 1 million in 2020 due to the lack of registered sales as a result of the COVID-19 lockdowns, according to the Ministry of Agriculture and Rural Development.

The proportion of workers in the agriculture and livestock sector in Algeria was estimated at 9.6 per cent of the total number of workers and at about 10.16 per cent, and 9.88 per cent in 2017 and 2018, respectively. According to World Bank figures, the agricultural sector contributed 11.84 per cent, 12.38 per cent, and 14.23 per cent of GDP in 2018, 2019 and 2020 respectively.

Foreign Trade

The total value of Algerian exports amounted to $23.7 billion during the period from January to August 2021, an increase of 57 per cent compared to the same period in 2020 ($15.1 billion). Meanwhile, the trade deficit decreased by 87.9 per cent to $926 million in the first eight months of 2021, as a result of the rise in oil and gas revenues and the sharp decline in imports during the mentioned period.

Algeria, a member of the Organization of the Petroleum Exporting Countries (OPEC), remains highly reliant on oil and gas revenues, which account for more than 90 per cent of its total exports and 60 per cent of the state budget.

During the first eight months of 2021, Algerian exports outside the hydrocarbon sector amounted to $2.9 billion, an increase of 118 per cent, compared to the same period in 2020. These exports are estimated at 12.2 per cent of all Algerian exports by value.

The increase in exports varies according to the nature of the products that were exported during that period compared to 2020. The most prominent of these products are:

- Mineral and chemical nitrogen fertilisers: $886 million, compared to $524 million, an increase of 69.1 per cent.

- I ron and steel: $595.78 million, compared to $28.76 million, an estimated increase of 1,971.6 per cent.

- Inorganic chemicals: $501.8 million, compared to $150.1 million, an increase of 234 per cent.

- Sugar, sugary preparations, and honey: $288 million, compared to $173 million, an increase of 66.5 per cent.

Steel industry exports amounted to $190.81 million, an estimated 6.54 per cent by value of total exports outside the hydrocarbon sector.

In 2020, the value of total exports had decreased by 36.4 per cent ($14.2 billion dollars) compared to 2019. According to foreign trade officials at the Algerian Ministry of Trade, the sharp decline in Algerian exports resulted from the decrease in oil prices in international markets due to the contraction in demand as a result of the restrictions imposed to contain the coronavirus pandemic.

Algeria’s economy depends largely on revenues from oil and gas, which constitute 93 per cent of the country’s foreign exchange earnings, according to official government figures.

On the other hand, Algerian imports declined by about $9.18 billion (18.4 per cent) in 2020, compared to 2019. Despite the decline in total imports, the country’s trade balance deficit (the difference between the value of exports and imports) increased by 45.6 per cent ($5.02 billion) compared to 2019.

The ratio of total exports to total imports was 60.1 per cent, 17.9 per cent lower than it was in 2019.

The following table shows the country’s foreign trade balance:

Poverty

According to World Bank estimates, the GDP per capita at constant prices decreased from $4,701.3 in 2019 to 4,362.7 in 2020, a decrease of 7.2 per cent.

The coronavirus pandemic has exacerbated the economic crises facing Algeria, a member of OPEC. In addition to the serious repercussions of the pandemic, the losses incurred by the oil market since March 2020 have compounded the stifling crises faced by the Algerians.

A report by the Algerian League for the Defense of Human Rights (LALADDH) indicates that the number of Algerians living below the poverty line (the international poverty line is $1.9 per day) has jumped to 15 million in 2021, or about 38 per cent of Algerians, compared to 24 per cent in 2014. Their social conditions have deteriorated and they are unable to acquire the basic necessities of life, which means that one out of every three Algerians is living in extreme poverty.

LALADDH confirmed that the figures are based on the census and rely on a number of authorities.

According to LALADDH, the residents of more than 1,400 impoverished municipalities live on subsidies from the joint local community fund, and of these, 800 municipalities are classified among the poorest with some 20 million residents. According to The Independent Arabia, in order to reduce disparities caused by poor resources, 30 states depend on a fund to provide for citizens’ needs and to manage their daily affairs.

The League referred to a recent report by the World Bank, which revealed that about ten per cent of Algerians entered the cycle of poverty due to high unemployment and the high rate of inflation, which in 2020 reached 9 per cent. The financial difficulties Algeria has faced in recent years have caused a rise in the rate of unemployment, which is approximately 1.5 per cent higher than it was in 2019.

The World Bank has called on the Algerian government to pay special attention to families that are the most impoverished and in need of aid during the period of recovery from the crisis, as they were disproportionately affected by the negative repercussions of the coronavirus pandemic. The effects of COVID-19 in 2020 have made it clear that there is an urgent need to reform the health-care system in Algeria to be a just and equitable system for all.

Construction Sector

Thanks to the rise in oil and gas revenues, increased public spending has revived the construction sector. Government programmes to renovate physical infrastructure have also led to the construction of highways and new public transportation facilities, such as urban railways and trams, as well as programmes to address the housing crisis. New schools and other government buildings will also be built, including the Great Mosque of Algiers mega project.

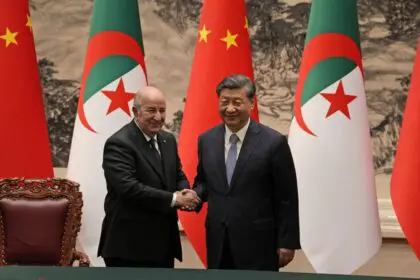

Most of the construction is carried out by foreign companies from other Arab countries (such as Lebanon and the Gulf states) and Europe, as well as China and Turkey (which have built new apartment buildings on the outskirts of major cities). All foreign companies are obligated to enter into joint ventures with Algerian construction companies. It is expected that this sector will continue to develop, because there is a constant need to build new housing and the government’s programme to invest in infrastructure is not yet complete. However, like other economic activities, the construction sector is highly reliant on continued state investments, which in turn depend on developments in international energy markets.

Tourism

Tourism in Algeria is described as the sleeping giant that can lead the development train in the largest African country in terms of area, its mix of cultures, its geographical and ethnic diversity, and above all, the hospitality of its people.

Algeria has significant tourism potential, especially in the Tassili and Hoggar regions as well as in the desert. It also hosts 22 Roman sites, including seven sites listed on the UNESCO World Heritage List, in addition to beaches extending over a distance of 1,644 kilometres. Algeria is the second-most-important tourist destination in the world for Roman monuments after Italy.

Sky News Arabia quoted UNESCO as saying, “The most beautiful sunset in the world is the one that we see at the summit of the Askram, which is located within a chain of stagnant volcanic mountains in the state of Tamanrasset.”

According to Sky News, there are studies indicating that the cave drawings in southern Algeria are the oldest drawings in history dating back to 9,000 BC, during the Stone Age.

Despite all this wealth, the tourism situation in Algeria seems fragile, in contrast to some isolated attempts led by civil society to promote tourism.

Algeria is considered one of the countries most visited by European tourists due to its geographical proximity, as well as relatively low prices and warm hospitality. Algeria also enjoys great natural, cultural and ethnic diversity, with each region having its own distinctive character and singular traits.

These include the singular pristine desert character of the southern regions, in which oases and unique rock formations are scattered, including the Djanet Oasis, the Citadel of Beni Hammad, the M’zab Valley, and the Tassili n’Ajjer mountain range and the Casbah of Algiers. In addition, there is the historical character of the cities and regions of the north, which are home to Roman ruins, churches and ancient buildings, the capital Algiers with its modern facilities, and the city of Oran with its Andalusian, Arab and Ottoman monuments.

International tourism revenues to Algeria accounted for just 0.37 per cent of the country’s total exports in 2019, compared to 0.44 per cent in 2018, according to World Bank figures. Looking at the aforementioned two rates, many experts deem the tourism sector as one of the most backward in the country. Until things change, investors continue to rely on local and domestic tourism, which remains unable to lure the more than 3 million Algerians who travel to Tunisia each year in search of superior tourism services.

Banking

Six state-owned banks still dominate 95 per cent of Algeria’s commercial market, but Citibank, HSBC, BNP Paribas, Société Générale and banks from the Arabian Peninsula are also active in the country. International money transfer services, such as Western Union, are also available.

The collapse of El Khalifa Bank in 2003 shook the government’s confidence in the private banking sector, despite the flaws in state-owned lenders. As a result, banking reform gradually progressed in the wake of the 2008 global financial crisis, and the privatisation of the leading state-owned bank Crédit Populaire d’Algérie (CPA) was suspended indefinitely.

Barriers to cash transfers abroad and the archaic domestic cash transfer system pose challenges to foreign investment in the country. Although the Algerian central bank has created a system to allow payment by check and credit card, this system is still very new, and neither checks nor credit cards are common as not many sellers have adapted to it. ATMs are installed in some locations, including five-star hotels. Algeria remains a cash-based society. In late 2010, the Algerian government retroactively banned commercial loans after July 2009 from shareholders abroad.

The Algerian government has adopted numerous reforms based on economic and social requirements. In the early 1990s, especially with the Money and Credit Law (1990), the Algerian authorities sought to liberalise the activities of banks in order to improve performance. As a result, the Algerian banking system has changed radically, and in 2016 consisted of 20 commercial banks, eight financial companies and a group of liaison offices of foreign banks.

In 2020, the lending rate increased by only 3.1 per cent, compared to 8.8 per cent in 2019, as the additional lending that can be provided by banks will increase long-term risks, as some borrowers faced weakness in financial solvency, as a result of the repercussions of the Corona pandemic.

Credit rating agency Moody’s was therefore quick to warn of the deterioration in the quality of the Algerian banks’ assets, which could exacerbate the problem of non-performing loans amounting to 12.3 per cent of total loans, according to the available data. That prompted the Central Bank of Algeria to take a series of measures, including postponing or rescheduling loan instalment payments for customers negatively affected by the consequences of the pandemic. It also extended credit to customers who had already benefited from measures to postpone or reschedule their debts, and reduced the minimum required liquidity rate and the rate of capital adequacy.

On April 1, 2021, the Algerian central bank announced the extension of measures to limit the negative effects of the pandemic on the national economy and Algerian banks. This marked the third extension after the implementation of the procedures on April 6, 2020.

According to a report issued by Moody’s, these measures will help limit the deterioration in the quality of local banks’ assets by supporting the broader economy, and maintaining control over the liquidity challenges of some borrowers so that they do not turn into solvency risks.

Despite this, Algerian banks are based on a sound capitalization, which may help them absorb some losses. The ratio of provisions to capital reached 14 per cent in December 2020, compared to the minimum regulatory minimum of 7 per cent, and the capital adequacy ratio reached 18 per cent, compared to the minimum requirement of 9.5 per cent.

It should be noted that Algerian banks have historically enjoyed good profit rates, with a return on assets of 2 per cent in 2017, according to the latest available figures.

Labour Force

The total workforce in Algeria (15-64 years) at the end of 2020 amounted to some 12.32 million people, compared to 12.72 million in 2019. According to World Bank figures, this represented a decrease of about 3.15 per cent. Women comprised 20.13 per cent and 19.88 per cent of the total size of the workforce in the country in 2018 and 2019 respectively, after it reached its historical peak in 2017 with a participation rate of 20.40 per cent.

A survey by the National Bureau of Statistics in 2018 showed that 16.1 per cent of the total workforce worked in the construction sector, 16.1 per cent worked in trade, and 15.8 per cent in the public sector outside of health. Some 14.4 per cent worked in the health sector and social work while 11.7 per cent worked in manufacturing.

The private sector in the country absorbed 6.95 million workers, or 63 per cent of the total employment in the country, according to a labour market survey conducted by the National Bureau of Statistics in April 2018. The public sector absorbed about 4.09 million workers, or 37 per cent of the employed population, which is estimated at 11.048 million workers.

The Bureau’s figures indicated that nearly seven out of ten workers are wage earners (69.6 per cent), noting that this percentage is higher among female workers, estimated at 75.3 per cent.

Algeria has witnessed a remarkable improvement in the unemployment rate, from 29.8 per cent in 2000 to its lowest level in 2021, at a rate of 11.5 per cent.

Basic Indications:

Latest Articles

Below are the latest articles by acclaimed journalists and academics concerning the topic ‘Economy’ and ‘Algeria’. These articles are posted in this country file or elsewhere on our website: