Introduction

The State of Kuwait is a small constitutional monarchy on the Persian Gulf. The Emir and his family control the executive branch of government, and appoint the prime minister (who has always been a member of the ruling al-Sabah family). However, there is a democratically elected 50-member legislature with some real powers, although appointed ministers are ex-officio members of the legislature. Kuwait did not experience the same level of unrest during the Arab Spring as some countries in the region, but there were various protests in 2011, alleging corruption in the ruling family and demanding citizenship for stateless Arab residents.

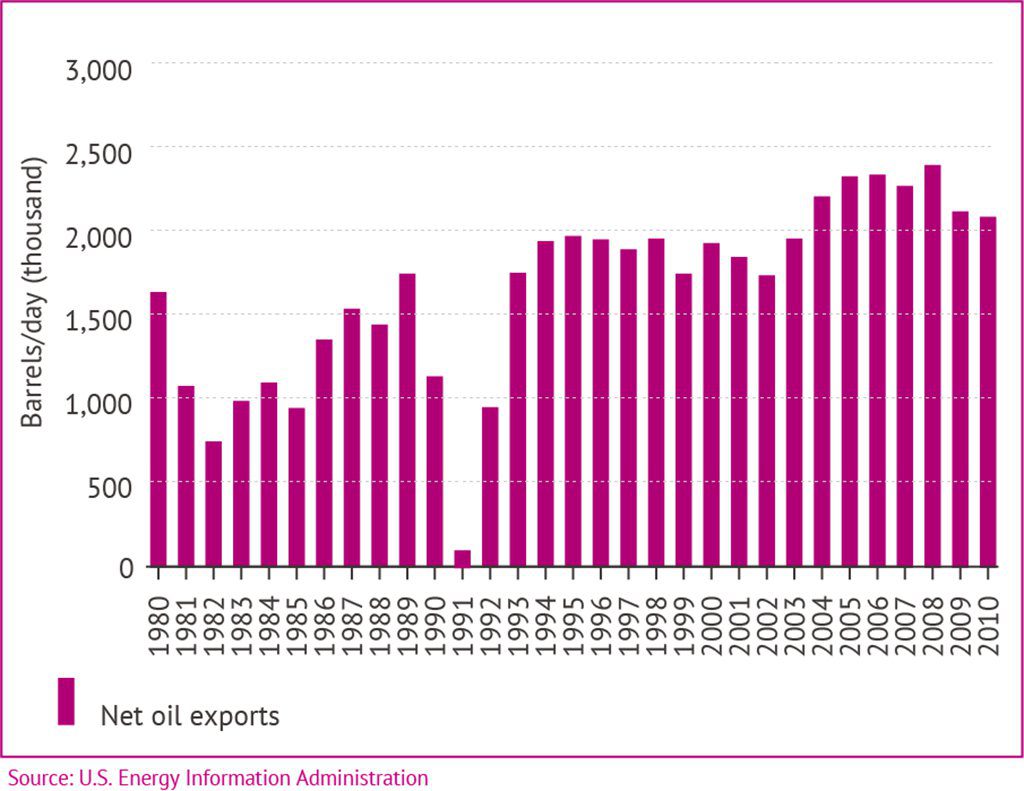

A (founding) member of the Organization of the Petroleum Exporting Countries (OPEC), Kuwait has one of the largest per capita petroleum reserves in the world as well as large reserves in absolute figures. It is also a member of the Gulf Cooperation Council (GCC), a political and economic alliance of six Middle Eastern countries.

Kuwait has had a close military relationship with the United States since the 1990-1991 Gulf War, and an estimated 15,000 US military personnel are still stationed there. Kuwait’s energy infrastructure was badly damaged during the war, and over 800 oil wells were set ablaze by Iraqi forces.

Kuwait was a staging ground for US forces entering and leaving Iraq between 2003-2011 and currently serves as a base to back up the coalition fighting the Islamic State in Iraq and Syria (ISIS).

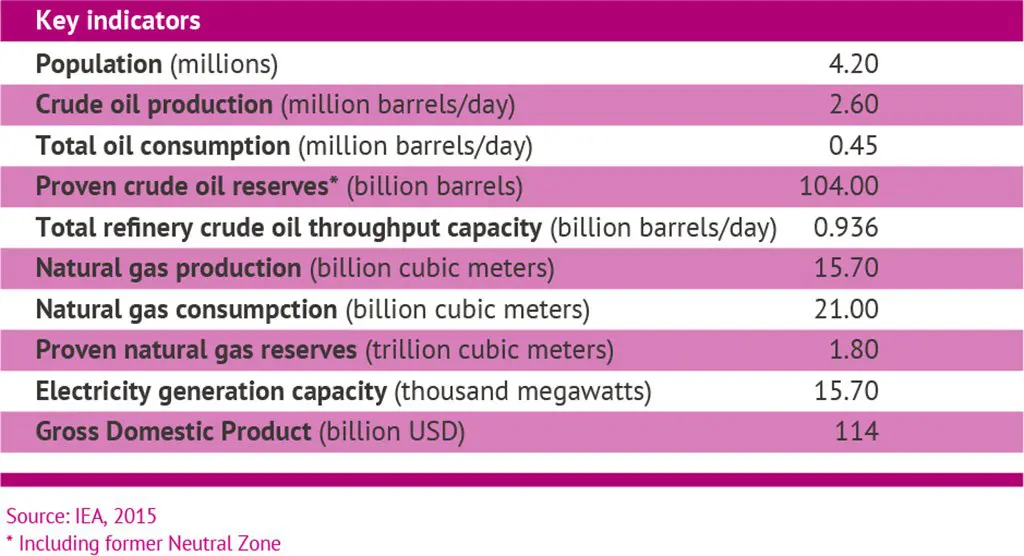

Kuwait has one of the highest incomes per capita in the world. This would be even higher if only citizens – who only make up around one third of the population – were included in the GDP-per-capita calculation. The Kuwaiti economy is less diversified than some of its GCC neighbours. Much of Kuwait’s territory has oilfields underneath it, so that although it is much smaller than Iraq and Saudi Arabia, with which it shares borders, its oil reserves are comparable.

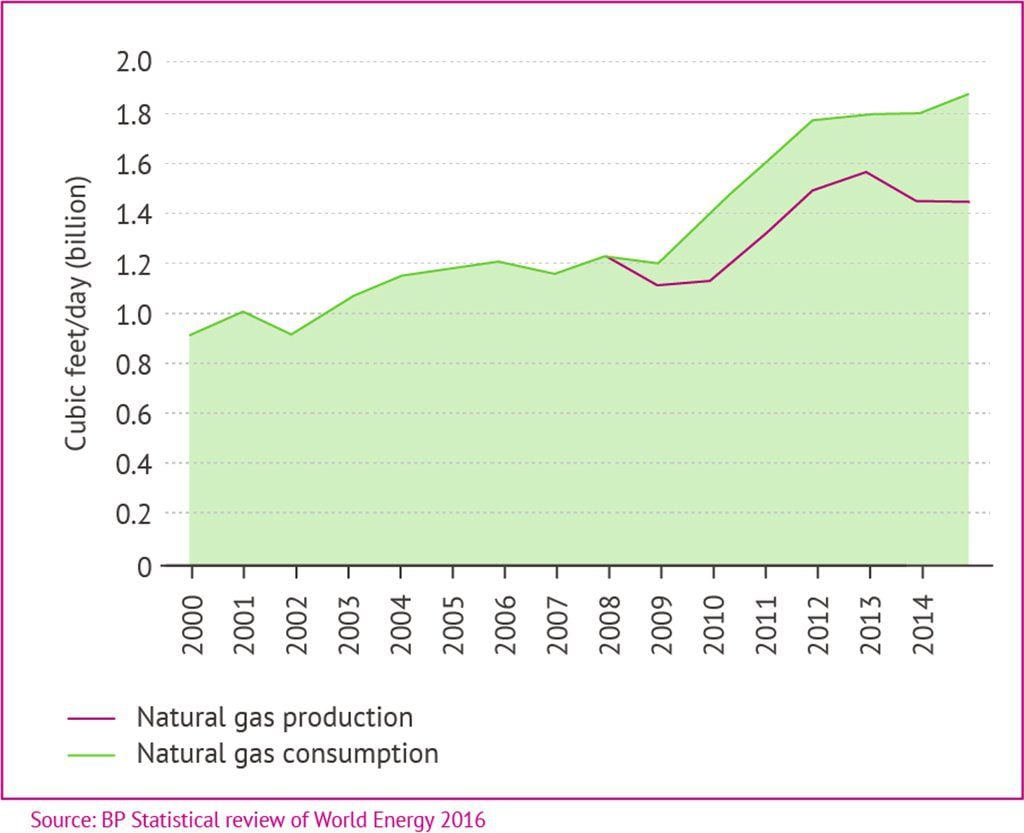

Like other GCC members, Kuwait is a high per capita energy consumer, much of it in its large oil and gas industry, as well as for air conditioning and desalination. Due to this lack of diversification, and the fact that the country has been a net gas importer since 2009, petroleum is of overwhelming importance as a source of government revenue. However, Kuwait has had generally more restrictive foreign investment terms than some of the other smaller monarchies bordering the Persian Gulf.

Finally, although the Neutral Zone between Kuwait and Saudi Arabia was abolished once the border was firmly established in 1970, revenues from oil produced within that zone (the southernmost quarter of Kuwait) is still shared between Kuwait and Saudi Arabia on a 50-50 basis. For various technical and political reasons, production has virtually come to a halt within the zone since early 2015.

Oil

Kuwait has an estimated 101.5 billion barrels (bbbl) of proven crude oil reserves, according to the Oil & Gas Journal. This does not include 50 per cent of reserves in the former Neutral Zone, which would add another 2.5bbbl of reserves to Kuwait’s total. At 104bbbl, only Saudi Arabia, Iran and Iraq have greater conventional reserves, although adding non-conventional reserves (such as oil sands) would put Venezuela and Canada ahead of Kuwait.

Given Kuwait’s relatively small land area, its reserves per square kilometre are enormous and include the Greater Burgan field, which is generally thought to be the world’s second largest. However, some have questioned the validity of such statistics, which are based on Kuwaiti government information.

Reserve figures were greatly increased in 1985, along with some other OPEC countries (to 92.7bbbl), and have been gradually increasing since. OPEC crude oil production quotas are connected to reserves, so a country claiming large reserves would obtain a less-restrictive quota.

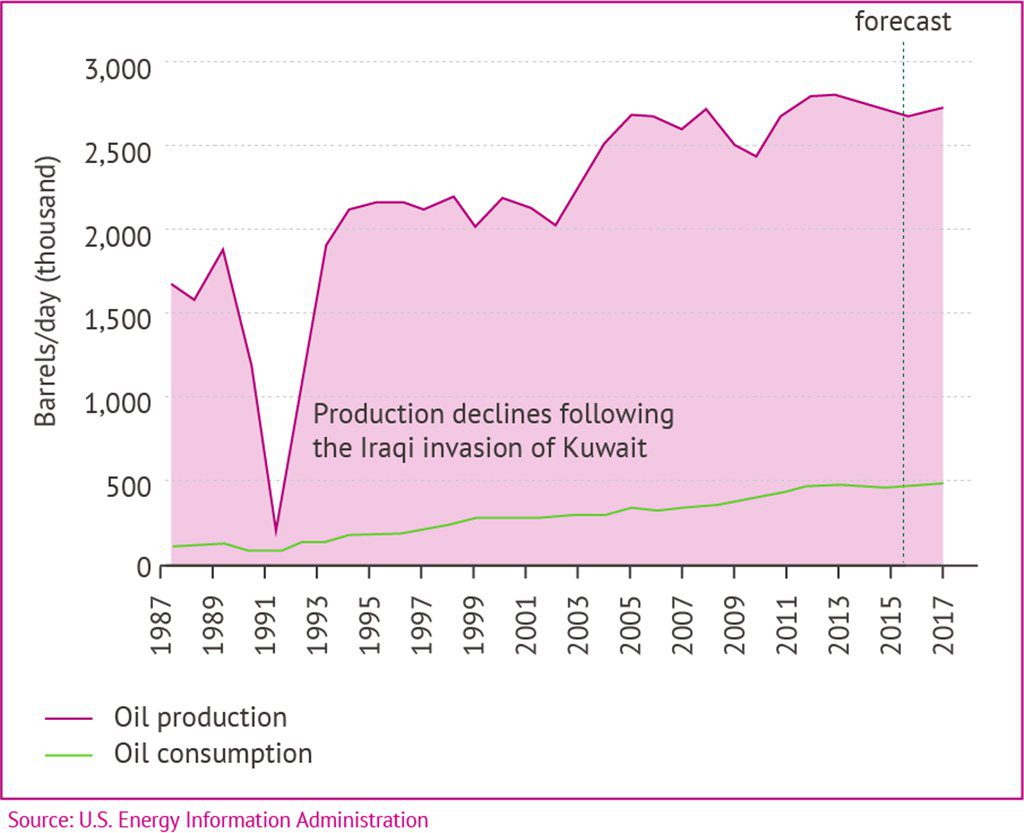

Following the Gulf War, Kuwait produced 2 million barrels per day (mb/d) or more. Production began to decline in the early 2000s, but was increased significantly in the 2003-2008 period, before declining again and remaining steady at around 3mb/d. With an estimated production capacity of 3.25mb/d, Kuwait is one of the few countries in the world that has at times maintained some spare production capacity. In mid-2014, Kuwait was hit by the steep decline in oil prices, but – as agreed within OPEC – did not cut production until the beginning of 2017. Since then, production has been around 2.7mb/d.

In addition to crude oil, Kuwait also produces about 20,000 barrels per day (bbl/d) of condensates and 150,000bbl/d of natural gas liquids. Production in the former Neutral Zone is about 660,000bbl/d onshore and 330,000bbl/d offshore, meaning that 500,000bbl/d of production and revenues is allocated to Kuwait.

Most of Kuwait’s production comes from very large onshore fields that were discovered at least 50 years ago. As mentioned above, the largest field complex is Greater Burgan, located just north of Kuwait’s part of the former Neutral Zone.

More than half of Kuwait’s production is from Greater Burgan, which comprises the Burgan, al-Maqwa and al-Ahmadi fields. Greater Burgan flows from natural pressure, without the need for pumping, minimizing production costs. However, production could be increased with additional measures. In 2013, the Kuwait Oil Company (KOC) started to experiment with water injection in the Wara reservoir.

Other production centres in the south include Umm Gudair, Minagish and Abduliyah. Water injection has been used at Minagish since January 2003 to enhance oil recovery and offset natural declines in production. An exploration well drilled in 2009 discovered light crude and associated natural gas at Mutriba oilfield, to the west of Raudhatain. As much as 80,000bbl/d were expected from this field when it was brought onstream in 2014.

Northern Kuwait holds the majority of the country’s larger fields other than Greater Burgan. Kuwait’s second-largest source of crude production is from the northern Raudhatain field, with a capacity of 350,000-400,000bbl/d. Sabriya is adjacent to Raudhatain and adds another 100,000bbl/d.

Kuwait’s oil sector’s organization is rather fragmented. The Ministry of Oil oversees the sector on a daily basis, with the Supreme Petroleum Council of ministers and private-sector leaders headed by the prime minister being ultimately responsible for setting oil policy. Kuwait’s state-owned umbrella company is the Kuwait Petroleum Corporation (KPC), which has various fully owned subsidiaries (usually referred to as the K-companies).

KPC manages domestic and foreign oil investments. KOC, the upstream subsidiary, was taken over by the Kuwaiti government in 1975 and manages all upstream development in the oil and gas sectors. Other subsidiaries are: Kuwait National Petroleum Company (KNPC, marketing and refining), Petrochemical Industries Company (PIC, petrochemicals), Kuwait Oil Tanker Company (KOTC, transport) and Kuwait Foreign Petroleum Exploration (KUFPEC, international upstream activities).

Kuwait’s constitution prohibits foreign ownership of the country’s natural resources and thus also production-sharing agreements. However, the former Neutral Zone has special arrangements that allow for much greater foreign company participation. The northern half, which is now Kuwait, is a concession owned by Chevron’s Texaco subsidiary, with the participation of Kuwait Gulf Oil Company, another subsidiary of KPC. Operations in the entire zone are overseen by a special Saudi-Kuwaiti joint venture, Khafji Joint Operations (KJO).

Because of Chevron’s greater control and returns on investment in this area, more aggressive enhanced oil recovery (EOR) techniques have been implemented, including saltwater injection. KJO has also awarded Chevron a $340-million deal to operate a thermal EOR project in the onshore section of the Neutral Zone.

For the rest of Kuwait, bringing in foreign investment and technology to maintain and even expand the emirate’s production capacity has been complicated by politics. Project Kuwait, conceived in the late 1990s, was supposed to create proper incentives to attract foreign investment.

However, unlike the other GCC states, Kuwait’s parliament had to approve the resulting contract structure, which it considered unconstitutional. It thus opposed schemes that would have given foreign companies lucrative concessions rather than merely service contracts.

Hence, KOC had to build capacity, at a much slower pace, on its own or with service contracts where possible. In order to allow investment by international oil companies (IOCs), an incentivized buy-back contract (IBBC) was developed, which neither involves production sharing nor concessions. However, these contracts too require parliamentary approval, which remains a delaying factor. Kuwait has three large refinery complexes (al-Ahmadi, Abdullah and al-Shuaiba), all of which are owned and operated by KNPC.

The combined throughput capacity is 936,000bbl/d. Petroleum products make up a sizeable proportion of Kuwait’s oil exports (about 750,000bbl/d). However, Kuwait’s domestic petroleum product consumption was around 450,000bbl/d in 2016 and is growing rapidly. This will limit the amounts available for export if production cannot also be increased.

Partially in response to this, as well as to capture the added value from refined/processed product as compared to crude oil exports, various plans to expand Kuwait’s refining capacity have been initiated. There are two main components to these plans: a new 615,000bbl/d refinery complex at al-Zour, south of Kuwait City, and the Clean Fuels Project.

The projects have an estimated combined cost of over $31 billion and consist of upgrading the existing refineries, building a new refinery at al-Zour and shutting down the al-Shuaiba refinery. Political opposition (which rarely has anything to do with the plans themselves and a great deal to do with fears of massive corruption) again led to delays and cancellations in the bidding process. At the time of writing, it was still unclear when the refinery would open.

Al-Zour will play two key roles for Kuwait: it will produce low-sulphur fuel oil feedstock for power stations, in order to meet rapidly growing domestic demand, and it will soak up the country’s heavy oil output, which is set to rise as part of plans to increase overall production capacity to 4mb/d by 2020. Total refinery capacity is expected to rise to 1.415mb/d, and the low-sulphur fuel capacity will be increased to reduce pollution.

Mina al-Ahmadi is the country’s main port for the export of crude oil. Other operational oil export terminals are Mina Abdullah, Shuaiba and Mina Saud, also known as Mina al-Zour. To handle increased production generated by Iraq and the northern fields, a new terminal is planned for Bubiyan Island. Unlike Saudi Arabia and the United Arab Emirates, Kuwait does not have, nor will have in the near future, a means for its exports to bypass the Strait of Hormuz, the world’s primary oil chokepoint and a potential source of vulnerability in the event of war, terrorism or piracy.

Natural Gas

Like oil, Kuwait’s gas sector is managed by the Kuwait Petroleum Corporation (KPC). Although Kuwait has large natural gas reserves by global standards – around 1.8 billion cubic metres (BCM), according to the latest estimate published by the Oil & Gas Journal and OPEC – compared to nearby countries such as Iran, Qatar and Saudi Arabia, its reserves are small.

There have been new discoveries in recent years, but it is the failure to fully exploit long-established reserves that has forced Kuwait to become a net natural gas importer. There are some major non-associated fields in the northern deep-water fields that have yet to be developed, and some relatively recent discoveries of associated gas onshore in the northern oilfields.

Kuwait needs large quantities of natural gas to generate electricity (power outages are not uncommon in the summer months) for water desalination, petrochemical production and enhanced oil recovery techniques. Production was about 30 million cubic metres per day (MCM/d) in 2015, less than its domestic demand. Because much of Kuwait’s natural gas is associated, production can vary with crude oil production.

There are some major non-associated fields in the northern deep-water fields that have yet to be developed, and some relatively recent discoveries of associated gas onshore in the northern oilfields. Perhaps the most important discovery of recent years are the Jurassic fields, with an estimated, though not proven, reserve total of 991BCM.

Yet despite the enormous estimated reserves, the fields are only producing 3.9MCM/d, well below what was planned for the first phase. KOC is carrying out the work, with Royal Dutch Shell acting as technical advisor. An extremely complex geological formation, the Jurassic fields have proven to be more difficult and expensive to produce from than originally anticipated. In phase 3, planned production is 28.3MCM/d. However, this has been delayed until at least 2019, over parliamentary objections to the agreement with Shell.

One of the Kuwaiti government’s major goals is to increase domestic gas production, thereby reducing imports and ending the use of crude oil for power generation that could otherwise be exported. With the recent expansion of EOR techniques, which require gas, demand has increased further.

Kuwait began importing liquefied natural gas (LNG) to the floating Mina al-Ahmadi GasPort in 2009, as demand outpaced supply. Most LNG cargoes come from Qatar. The possibility of a pipeline from Qatar has been explored, but this would pass through Saudi Arabia and the Saudis have not approved such a plan. Kuwait has also looked into importing gas from southern Iraq, with which it does share a border, and is considering an onshore LNG regasification facility with greater capacity.

Electricity

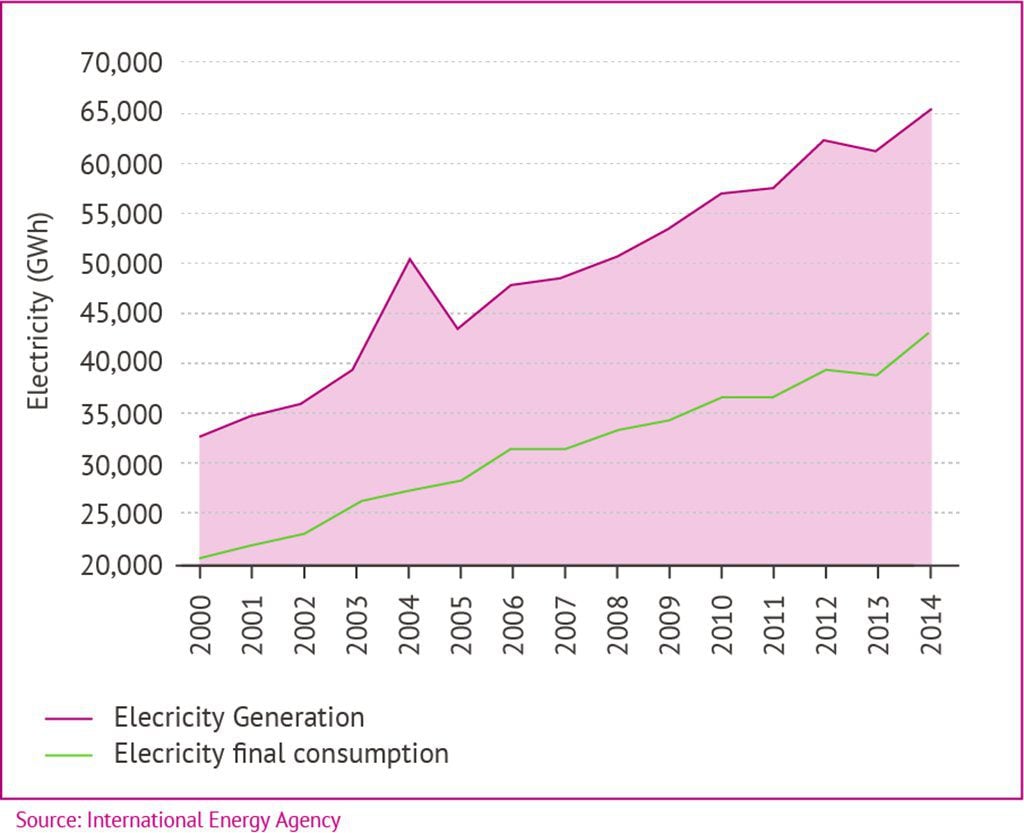

In 2015, Kuwait had an installed generation capacity of 15.7 gigawatts in five thermal plants: Doha East, Doha West, al-Subiya, Shuaiba South and al-Zour South. Kuwait Electric Power System (KEPS) generates, transmits and distributes electricity under the guidance of the Ministry of Electricity and Water. All plants except al-Subiya are combined with desalination plants.

The transmission network comprises 854km of transmission lines and 18 substations that connect the transmission system. The distribution network comprises 4,000km of distribution lines of 132 kilovolts (kV) and 246 substations that connect the distribution system at 33kV and 11kV.

An additional 2,000 megawatt (MW) is generated by al-Subiya II, in northern Kuwait. The Ministry of Electricity and Water has indicated that it plans to generate 10 per cent of Kuwait’s electricity from renewable sources (wind and solar) by 2020. So far, little progress has been made in this area, although KOC recently opened Sidra, the country’s first solar power plant, with a generation capacity of 10MW.

Additionally, power demand has been growing strongly, in part due to high energy subsidies. Rolling blackouts during the peak summer months are not uncommon. Plans to cut subsidies, which amounted to 6.5 per cent of GDP in 2015, have met with resistance in parliament but may be implemented by the end of 2017 nevertheless.

As a member of the GCC, Kuwait is connected to the GCC grid. Plans for nuclear energy generation were tabled in 2009 but were cancelled again in 2011, after Japan’s Fukushima nuclear disaster.