Introduction

Natural gas and oil have played a pivotal role in the economy of the Kingdom of Bahrain for decades. Like the other Gulf Cooperation Council (GCC) member states, the kingdom is concerned about the long-term sustainability of its hydrocarbon revenues, as oil and gas reserves would eventually run out; this led the government to devise strategies to diversify the Bahraini economy. According to the Bahrain Economic Development Board, in 2019, new companies’ investments have put more of a focus on financial services, information technology, communications technology, industry, logistics, real estate, tourism, education, and health care.

Studies have predicted that by 2040, oil revenues will dwindle as a result of less demand in the global market. For this reason, economic diversification is emerging as a pressing issue in the Arab Gulf States. The slowdown in the global economy caused by the Coronavirus pandemic brought Brent crude prices down from $64 per barrel at the beginning of 2020 to $23 in April 2020, putting the fiscal positions of GCC countries, including Bahrain, under considerable pressure. According to the financial statements, the total budget deficit for the kingdom for 2020 amounted to 1.624 billion dinars ($4.31 billion), an increase of 817 million dinars ($2.17 billion) over the approved budget; The deficit in public finances and the external account has worsened, after falling in 2019, according to World Bank reports.

State revenues amounted to 2.139 billion dinars ($5.67 billion), 27 per cent lower than the approved budget due to the decline in oil prices. Revenues rose to 1.119 billion dinars ($2.97 billion) in the first half of 2021, and up to 23 per cent from the same period in 2020, with oil revenues increasing by 33 per cent due to a resurgence in oil prices, as well as a 4per cent rise in non-oil revenues as a result of economic diversification policies. This reduced the government’s budget deficit in the first half of 2021 by 35 per cent ($1.38 billion) compared to the previous year’s period.

After contributing 85 per cent of Bahraini budget revenues in previous years, oil and gas declined by 22 per cent in 2021 and 23 per cent in 2022, accounting for 63 per cent and 62 per cent of total budget revenues in two years, respectively.

The Bahraini government does not have many options to cover these deficits, as it has lower foreign assets and fewer oil resources than the neighbouring GCC States.

Other major economic activit ies of the Kingdom of Bahrain are the production of aluminium- Bahrain’s second largest export after oil and gas – finance and construction. The government continues to seek new natural gas supplies as feedstock to support the petrochemical and aluminium industries. In April 2018, Bahrain announced the discovery of an essential oil field off the country’s west coast but still had to assess the amount of oil that could be profitably recovered.

In addition to addressing their current financial problems, the Bahraini authorities face the long-term challenge of strengthening Bahrain’s regional competitiveness; particularly with regard to industry, finance, and tourism, as well as reconciling revenue constraints with popular pressure to maintain generous State welfare facilities and support for the large public sector. Since 2015, the government has raised subsidies for meat, diesel, kerosene, and gasoline, as well as electricity and water prices. It is still working on a plan to reduce the amount of government support it provides to citizens’ bills.

According to the World Bank, Bahrain’s future prospects depend on the uncertainties associated with the emerging coronavirus pandemic, vaccine efficacy, global oil markets’ evolution, and the reform process. Growth is expected to remain at a modest 3 per cent on average over the medium term, owing to fiscal austerity measures, counterproductive to post-pandemic recovery efforts.

Gross Domestic Product

The Bahraini economy, facing a multifaceted crisis, experienced a contraction of 5.82 per cent in 2020, with an overall decline of 7.81 per cent compared to 2019. Gross Domestic Product (GDP) declined by 2 per cent as a result of oil production being determined under the OPEC + production reduction agreement. Low consumer demand led to an overall 2.6 per cent contraction in 2020 compared to 2019.

According to the Information and eGovernment Authority (IGA), the construction sector fell by 0.77 per cent in actual prices in 2020, and the mining and quarrying sector by 12.28 per cent in actual prices and 11.43 per cent in current prices. Manufacturing fell by about 1.79 per cent in actual prices while growing by about 5.31 per cent in current prices. Hotel and restaurant activity declined by 13.58 per cent in reality and 13.52 per cent in current prices. These large changes reflect the effect of the pandemic on the tourism sector.

Private education and health services decreased by 0.54 per cent and 0.21 per cent in actual and current prices, respectively. Personal health services also experienced a relatively low rate of 0.02 per cent in substantial expenses, while they rose by 0.06 per cent in current prices.

When comparing economic growth rates for sectors and financial activities during the fourth quarter of 2020 with the corresponding quarter in 2019, economic growth was found to have declined by 5.51 per cent and 7.28 per cent in current prices. The results also showed that the oil sector declined by 8.62 per cent at constant prices, 30.90 per cent at current prices, and the non-oil sector declined by 4.82 per cent and 3.27 per cent at stable and current prices respectively.

In the wake of the Coronavirus pandemic and its direct impact on air traffic and hotel business, the hotel and restaurant sector declined by 42.22 per cent and 42.58 per cent in actual and current prices, respectively. Similarly, transport and communication activity fell by 30.78 per cent in actual prices and 29.27 per cent in current prices.

The IGA report also revealed a decline in construction activity in 2020 of 2.14 per cent at constant prices and 10.89 per cent at current prices. Manufacturing also declined by 9.12 per cent at stable prices and grew slightly at 0.79 per cent at current prices. Similarly, commercial activities declined at 9.57 per cent and 42 per cent in continuous and current prices, respectively.

Economic recovery

In 2021, the results recorded during the second quarter showed an improvement in the performance of the Bahraini economy as the pace of economic recovery continued.

Real GDP (in constant prices) grew by 5.7 per cent in the second quarter of 2021 compared to the same quarter of 2020, and by 3.5 per cent on a quarterly basis compared to the first quarter of 2021 with regard to Finance and National Economy.

Nominal GDP (in current prices) also grew by 20.7 per cent annually and 6.4 per cent quarterly. For non-oil sectors, real non-oil GDP (in constant prices) increased by 7.8 per cent during the second quarter of 2021 and 2.6 per cent quarterly. Non-oil GDP in current prices increased by 12.8 per cent on an annual basis, and 4.4 per cent quarterly.

Furthermore, the oil sector has grown (at current prices) by 98.3 per cent and 18.9 per cent on an annual and quarterly basis, respectively, supported by improved oil prices on world markets.

The sector experienced a 2.4 per cent decline (in constant prices) annually due to a quarter-to-quarter variation in production according to seasonal changes. GDP has been at its highest level since the end of 2019.

The report reflected the GDP performance of several non-oil sectors at current prices, with communications and communications with the highest growth of 44.9 per cent, hotels, and restaurants with 40.7 per cent growth, followed by manufacturing with 24.2 per cent growth, and financial projects with 10.7 per cent on an annual basis.

Industry

The current industrial program me was established in 1975 as a means of diversifying oil and natural gas products. ِAs a result, the contribution of manufacturing to GDP reached 17.34 per cent in 2015.

The manufacturing sector is the primary driver of the kingdom’s economic development and the backbone of national exports. Furthermore, it is the polarising factor of hard currencies after the oil and gas sector and fuels the creation of high-wage jobs.

In addition to the oil and gas industries, there are several major industrial sectors in Bahrain, including:

- Aluminium industry.

- The petrochemical and plastic industry.

- Food processing.

- The garment industry.

- Engineering industries.

- Handicrafts.

Over the course of 2020, the manufacturing sector contributed more than BD 2.3 billion ($6.053 billion) to the national economy, contributing about 18 per cent of GDP, providing a total income of about BD 700 million ($1.842 billion) and equivalent to 25 per cent of the actual wages paid by the private sector.

Bahrain has taken the necessary steps to diversify its economy, with evident efforts in the vibrant manufacturing sector and the growth of heavy industries in the kingdom. The aluminium industry is one of the strategic sectors that has driven Bahraini economic diversification, accounting for 12 per cent of the kingdom’s gross domestic product.

In the meantime, Bahrain continues to benefit from its oil and gas resources, with significant investment in the petrochemical sector. This highlights the $5 billion spent on modernization at BOC and the expansion of the $ 515 million gas plant by BNG.

In addition to these industries, other major industrial sectors, such as food processing, ready-made clothing, engineering, and handicrafts, thrive. According to official sources, the contribution of the industrial sector to GDP is 16 percent.

The Government has established two new industrial parks to attract foreign companies to Bahrain, and has also expanded the sector to facilitate the growth of domestic industry. In addition, it is constantly looking for new industrial projects to attract foreign investment.

The Bahrain International Investment Park (BIIP) is one of the most important facilities of the Kingdom of Bahrain. It acts as a modern industrial zone designed to cover the financial investment needed by factories, including the needs of infrastructure and incentives that contribute to the growth of the industrial sector.

The BIIP is designed to attract foreign direct investment with high-quality projects as well as domestic, export-oriented jobs. The region’s administration follows the latest industrial standards to create quality jobs and develop the investment environment in the kingdom.

The number of employees in the industry was 328,202 in 2018 and 346,036 in 2019, accounting for 35.40 per cent, and 35.25 per cent of the kingdom’s total labour force in two consecutive years.

Agriculture and Fishing

According to t he Food and Agriculture Organization of the United Nations (FAO), the agricultural land in Bahrain covers an estimated 8,600 hectares of which 1.1per cent is forested by the kingdom. In 2017, Bahraini agricultural producers, through 900 local farms, covered 25 per cent of local market needs. Palm trees occupy most of the cultivated area, followed by tomatoes, wheat, and onions.

Bahrain implemented a national strategy for the development of marine farming in order to make a qualitative shift in the level of fish production over the next 5 years. The National Program for Training Local Competence in Fish Farming was launched through an agreement with the “Empowerment” Action Fund, which aimed to support the training of 15 Bahraini farmers in local fish farming within and outside the country. The programme is proving to be one of the most successful programs for promoting the fish sector in support of food security in Bahrain.

However, the fishing sector commands the most attention of the Government. According to FAO, Bahrain’s entire fishing industry is based on traditional methods, following the 1998 ban on industrial trawling of shrimp. Prior to that year, nine trawling vessels made of steel operated in Bahrain’s waters. These vessels were supposed to fish in waters more than twenty metres deep. However, they often engaged in trawling in shallow waters, causing disputes with other fishermen. Its use was banned on June 1st, 1998.

Bahrain’s marine waters have shown a decline in fish stocks for several decades. However, in the first decade of this century, re-storage became a routine practice approved by the former General Commission for the Protection of Marine Resources, the Environment, and Wildlife (now the Supreme Council for the Environment). Bahrain’s fishing industry has already started looking to recycle water from farmed fish.

According to FAO, the production of aquaculture by farming has declined from 14 tonnes in 2016 to 5 tonnes per year in 2017, 2018, and 2019.

In the agricultural sector, 19 agrarian plots in the High Hurrah area have been provided to 19 Bahraini small-scale farmers, with whom 10-year contracts have been agreed upon, to ensure the sustainability of their activity in the agricultural sector in support of food security.

The World Bank estimated that 1.01 per cent, 0.97 per cent, and 0.94 per cent of the total labour force worked in agriculture during 2017, 2018, and 2019 respectively.

Foreign Trade

The total value of commodity imports in 2020 was 4.798 billion dinars ($12.626 billion) compared to 4.984 billion dinars ($13.116 billion) in 2019, down 4 per cent. The top ten countries totaled 66 per cent of total commodity imports, while imports from the rest accounted for 34 per cent.

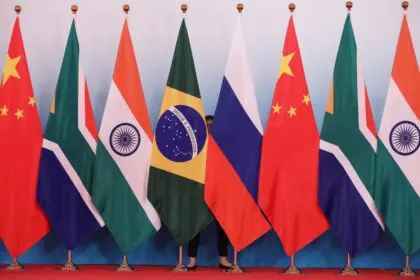

China ranks first in commodity imports, with a value of US $1.747 billion (14 per cent), followed by Saudi Arabia with $926 million (7.3 per cent). Australia ranks third in imports, worth $868.4 million (6.9 per cent), followed by the United States, the United Arab Emirates, Brazil, Japan, India, Germany, and Switzerland, with a total value of US $4.750 billion (37.6 per cent).

Aluminium oxide is the most imported commodity ($873.7 million), iron ores and their concentrations are second ($768.4 million), followed by jeeps ($460.5 million).

Adversely, the value of national exports rose by 4 per cent, reaching $6.282 billion in 2020, compared to $6.047 billion in 2019.

Bahrain exported its products primarily to Saudi Arabia, with a value of $1.411 billion, followed by the United Arab Emirates at $544.7 million, while the United States is third in exports from Bahrain, worth $529 million.

In terms of the composition of Bahraini exports, ore aluminium mixtures were the most exported goods in 2020, valued at $1.008 billion, second is non-blended ore aluminium, valued at $950 million, followed by iron ore and its concentration at $676.3 million.

The value of re-export goods declined by 15 per cent to $1.779 billion in 2020, compared to $2.092 billion in 2019. The ten most important countries represent more than 87 per cent of the total re-export volume, while the rest account for only 13 per cent of the re-export volume.

Saudi Arabia ranked first in the re-export volume ($ 518.4 million), followed by the United Arab Emirates at $ 468.4 million, and the United States at $3 million for re-export ($ 165.8 million).

Jeeps are the most re-exported items, with a value of $263.2 million, followed by gold alloys ($142.1 million), and iron ores and their depressed centres ranking third, valued at $92.1 million.

The trade balance, which represents the difference between exports, and imports, was $4.566 billion, recording an 8 per cent decrease in the value of the deficit from the year 2019 ($4.979 billion).

Tourism

Tourism was the fastest-growing industry in the 2000s. Since the late 1990s, the Government has been attracting and providing facilities for foreign visitors. A special Directorate for Tourism Affairs was established by the Ministry of Culture to promote Bahrain as a destination for international conferences, sporting events, and recreational activities.

One of the government’s main successes was the inclusion of Bahrain in the International Grand Prix. The 2004 Formula One Grand Prix was the first of its kind in the Middle East and succeeded in achieving its goal of bringing the kingdom to the world’s attention.

In the same period, Bahrain began building exclusive recreational resorts, including multi-million-dollar projects, such as Pearl Island and Artificial Surf Islands, the Durrat al-Bahrain Project “Self-Sufficient City” on the southern tip of Bahrain Island, the Den Desert Resort and Spa at its centre, as well as extensive tourism development in the Hiwar Islands.

By 2007, 5.2 million people visited Bahrain each year for recreation as well as for conferences. Most of them (94 per cent) came from other Arab countries; of the remaining 6 per cent 72 per cent were European, 13 per cent American, and 12 per cent non-Arab Asian. Of these visitors, 1.3 million stayed for an average of 1.9 days at the country’s 96 hotels, indicating that most of them were Saudi nationals who visited for the weekend.

The most prominent aspect of Bahrain’s tourism is the tendency to ignore cultural sites in the country. Bahrain’s leading cultural destination, the Bahrain National Museum, received an unnoticed 87,000 visitors in 2006. Other museums received only a few thousand a year. The al-Arain Wildlife Park is the fastest-growing “official” tourist site, which received 72,000 visitors in 2006.

The Arab Spring unrest halted tourism within the country considerably. The 2011 Formula One Grand Prix was cancelled, along with other associated tourist events. Some cruise ships decided to no longer dock in the port of Bahrain, and restaurants, shops, and taxis lost customers.

Nevertheless, more than one hundred 5- and 4-star hotels were added over the next five years. In an effort by the Bahraini government to improve performance in the tourism sector, Vatel Hotel & Tourism Business School was inaugurated in October 2018, offering a bachelor’s degree in international hospitality management.,

The tourism sector’s contribution to GDP is estimated at 7 per cent. Bahrain, excluding residents and non-tourism arrivals, receives an average of 11.4 million tourists. 65 per cent are day trips (without accommodation), while an average of 35 per cent are one-night stays and more.

The Coronavirus pandemic has affected many economic sectors in the Kingdom of Bahrain, especially with falling oil prices accompanied by low demand and a multi-month economic shutdown in 2020, which was re-imposed in the first quarter of 2021 as the number of casualties in the country increased.

The tourism sector was among the sectors adversely affected by the pandemic, especially since tourism in Bahrain heavily depends on tourists from the Gulf States and beyond. Still, the closure of the airspace for long periods of time, which was then opened under the conditions of continuous checks, prompted most tourists to cancel their plans to visit during that period.

As a result of the pandemic, the number of tourist arrivals dropped to about 1.9 million in 2020, bringing total tourism revenue in 2020 down by 80 per cent from 1.5 million dinars (approximately $3.98 million) to 0.3 million dinars (roughly $800,000).

According to estimates by the Bahrain Chamber of Commerce and Industry (BCCI), the number of visitors arriving through the King Fahd Bridge linking Bahrain to Saudi Arabia decreased by 84 per cent in 2020 compared to 2019, due to the temporary closure of the bridge in March 2020 as a means of reducing the spread of the virus.

BCCI confirmed that the pandemic had led to the collapse of the tourism sector in the face of social restrictions, paralysis of airport traffic, and the complete closure of the border with Saudi Arabia for several months.

From the onset of the pandemic until January 2021, the average daily losses suffered by the tourism sector in its various industries were estimated at 4 million dinars (approximately $10.6 million) and the average monthly losses, 108 million dinars (roughly $268.5 million). In addition, losses have resulted from the cancellation or postponement of all 14 exhibitions and events scheduled for March 2020 to March 2021.

Banking

According to the Bahrain Economic Development Board, Bahrain has more than 40 years of experience as a leader within the financial sector in the Arabian Gulf. The most important reason for Bahrain’s prominent and influential role in the financial sector is the evolving regulatory environment overseen by the Central Bank of Bahrain. The Central Bank of Bahrain supported high-tech companies in the rapidly evolving financial technology sector by launching a pilot course for financial technology regulation in mid-2017. This course allows entrepreneurs to experience and develop their ideas with real clients before launching them into the market. This initiative is one of several initiatives adopted by the Central Bank of Bahrain in support of technological transformation in the financial sector of the Kingdom of Bahrain.

According to the Central Bank of Bahrain, there were 370 banks and financial institutions by the end of 2020, with a resource of $205.8 billion. The contribution of the financial sector to GDP in 2019 was 16.1 per cent. An estimated 13,737 people were employed in the financial sector in 2020.

The Central Bank of Bahrain has launched a series of financial decisions and facilities to address the effects of the spread of the coronavirus on the national economy. March 2020, the mandatory reserve ratio decreased from 5 per cent to 3 per cent. The total mandatory reserve of the Central Bank of Bahrain fell by 34 per cent in 2020, reaching BD 322.857 million ($849.624 million) in December, compared to 2019, when the reserve had reached BD 489.789 million ($1.289 billion) in December 2019.

Labour Force

According to the Labour Market Regulatory Authority (LMRA), the total employment of non-Bahraini nationals was 531,447 at the end of the first quarter of 2021, compared to 586,874 in the first quarter of 2020, down by 9.4 per cent annually. This was caused both by businesses shutting down due to the COVID-19 crisis, as well as the nationalisation of the workforce, where companies are required to employ more Bahraini nationals.

At the end of the quarter mentioned above, the total national labour force amounted to 153,757 Bahraini workers, an annual decrease of 1.9 per cent compared to 156,746 workers in the first quarter of 2020.

The World Bank estimates Bahrain’s unemployment rate in 2020 at 1.78per cent. However, the youth unemployment rate (per cent of total labour force ages 15-24) in Bahrain is much higher: 7.97 per cent in 2020, up from 5.62 per cent in 2015.

On work permits, the number of new work permits issued by the LMRA in the first quarter of 2021 was 36,732, down by an estimated 10.6 per cent annually.

Small enterprises with fewer than ten workers also accounted for 47.7 per cent of the total work permits issued to the employment category during the first quarter of 2021.

The total number of permits issued by the LMRA during the first quarter of 2021 was 45,670. 36,732 work permits, 1122 for investors, and 7,816 for dependents were issued. The total number of permits issued decreased from 48,165 in the same quarter of the previous year.

The number of permit renewal transactions processed by Bahraini authorities in the first quarter was 75,845, of which 60,802 were work permit transactions, 1,666 for investors, and 13,377 for dependents. The total number of renewals decreased from 98,239 in the first quarter of 2020.

The number of permit termination transactions processed by the LMRA at the employer’s request during the first quarter of 2021 was 34,707. Of which 30,009 were work permits, 205 were for investors, and 4493 were dependents.

The economic sector with the most significant number of new work permits for regular workers is still the construction sector with 31.8 per cent of the total standard work permits issued, followed by wholesale and retail with 19.8 per cent share, and housing and food. The service sector is 11.5 per cent.

In terms of wages, the average wage of Bahraini employees was BD 556 ($1,463) at the end of the first quarter of 2021, compared to BD 539 ($1,418) in the same quarter of 2020, an annual increase of 3.2 per cent. The average wage of a worker in the private sector was BD 455 ($1,197), an increase of 3.2 per cent per annum, while the average wage of Bahraini workers in the public sector was BD 714 (US $1,879), an increase of 1.7 per cent per year.

Latest Articles

Below are the latest articles by acclaimed journalists and academics concerning the topic ‘Economy’ and ‘Bahrain’. These articles are posted in this country file or elsewhere on our website: