Introduction

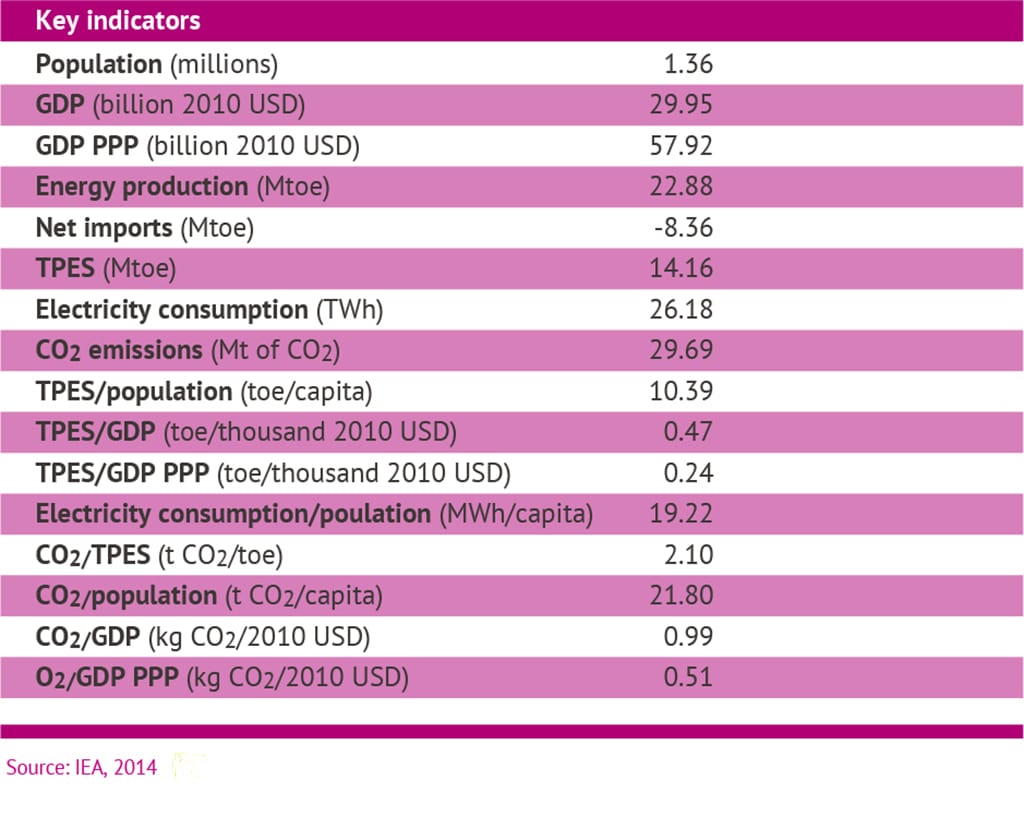

The Kingdom of Bahrain is the smallest country of the Gulf Cooperation Council in terms of land area, and consists entirely of an archipelago. However, with more than 1,3 million citizens, it has a larger population than neighboring Qatar (which counts about 313,000 citizens). The main island is densely populated, mainly due to the location of the capital, Manama. Bahrain also has the smallest hydrocarbon resources in the Gulf region, but oil and gas nevertheless play an important, though diminishing, role in the Kingdom’s economy. Bahrain is the oldest oil producer in the Gulf region: it was the first Gulf state to discover crude oil and built its first well in 1932. The Bahrain Refinery was established in 1936. It exports most of its oil as refined petroleum products, rather than crude oil.

These exports make almost 60% of Bahrain’s exports and 70% of the government revenue. Bahrain has two main hydrocarbon intensive industries, namely aluminums smelting and refining. Nevertheless, the economy is one of the most diversified in the region.

Bahrain is not a member of OPEC, despite the fact that its revenues come mainly from refining. It is a medium-sized natural gas producer and the country is self-sufficient in gas to generate its electrical power needs. Per capita energy consumption is very high, at about 800 million Btu (British thermal unit) annually. This reflect the country’s huge energy needs for air conditioning, oil refining, desalination and aluminum smelting.

Oil

As of 2015, Bahrain’s proven oil reserves stood at least at 100m barrels, all of which are located in the onshore Awali field. However, according to Trade Arabia Journal, this figure could be much higher. In addition to the 50,581 barrels per day (bbl/d) produced in Bahraini territory in 2015, Bahrain and Saudi Arabia share the 300,000 bbl/d of oil production from the offshore Abu Safah field. This figure is counted in Saudi oil production figures, but half of the output is allocated to Bahrain. According to the Bahraini National Oil & Gas Authority, in 2015 Bahrain obtained 150,942 bbl/d from Abu Safah field. The Tatweer Petroleum Company of Bahrain is the operating company – it is owned by NOGA, Occidental Petroleum, and the Mubadala Development Company of the Emirate of Abu Dhabi. Tatweer is drilling new wells and has been attempting to steam injection in an effort to increase production. In 2014, it invested $3.5 billion to boost the country’s field prowess. The aim is to increase production to 100,000 bbl/d in the next three to four years, by 2020.

Bahrain’s refinery has a nameplate capacity of 262,000 bbl/d of crude oil throughput, though the refinery has at times been operated at beyond normal capacity; it reached as much as 276,676 bbl/d in 2015. The Bahrain Petroleum Company, which is fully owned by the government, owns and runs the refinery. In total, Bahrain’s refinery production in 2015 was 98.117 million barrels, of which 10.480 million barrels were locally consumed and 87.637 million barrels exported. According to Alarabiya News, Bapco is planning to invest $6 billion to increase the crude refining capacity to 360,000 bbl/d by 2018 and lay new pipes for the oil from Saudi Arabia that provides the feedstock beyond Bahrain’s domestic supply.

In 2015, Bahrain and Saudi Arabia signed an agreement to share a new oil pipeline project. The Saudi Al Rabi company won the contract to build while the Emirati National Petroleum Construction Company will manage the undersea part of the project. As of 2016, these plans were in the financial closing phase.

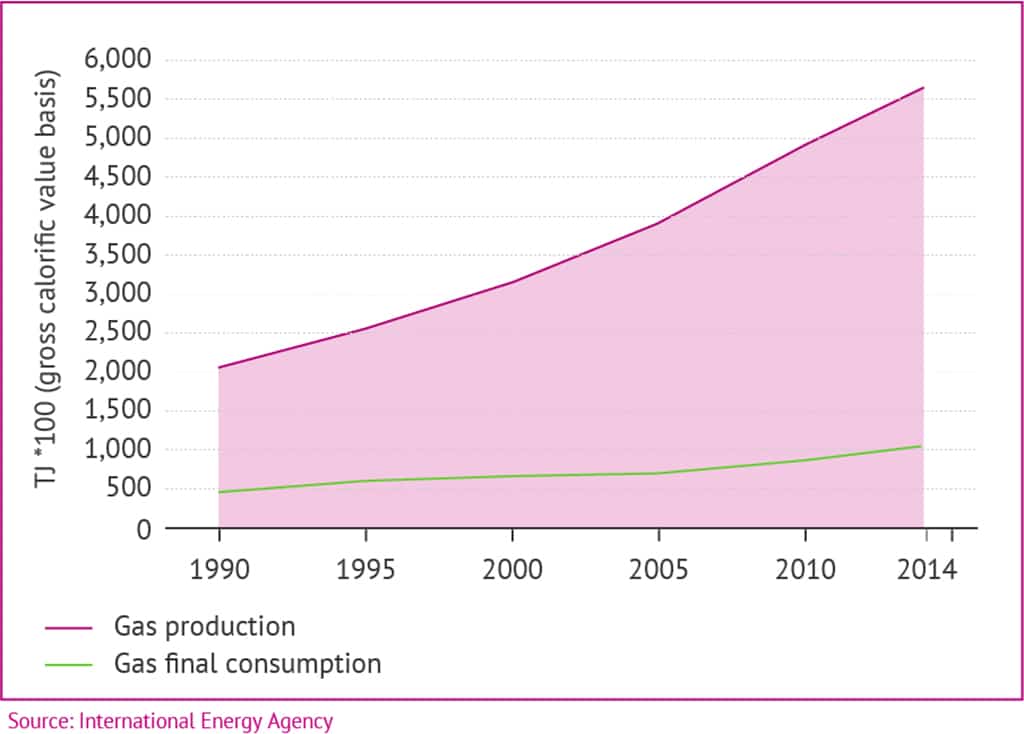

Natural Gas

According to the World Data Atlas, Bahrain’s proven dry natural gas reserves are assessed in 2015 at 3.30 trillion cubic feet, the smallest reserves of any of the littoral states in the Persian Gulf. Most of these reserves are associated with Bahrain’s oil field. Nevertheless, the reserves have been sufficient to provide for the Kingdom’s consumption for many years. The Bahrain National Gas Company was established in 1979 to capture associated natural gas at the Awali oilfield, which had previously been flared. Bahrain formed Banagas to process associated gas into marketable products and supply residual gas for local industrial use. Banagas is three-quarters state-owned, with the remainder owned by the Arab Petroleum Investment Corporation (APIC) and Caltex Bahrain (Chevron) at 12.5% each.

In 2015, Bahrain produced about 751,615 million Cubic feet of gas, an amount that does not meet the country’s demands.

Already in 2013, Bahrain’s natural annual gas consumption was at 15,7 billion cubic meters. This growing gap has forced the Bahraini government to take various measures. The country has already raised the domestic price for 2012 by 50% to $2.25 per million Btu, in order to slow demand growth. In order to generate new resources from the Awali field, the kingdom has also issued various exploring tenders and worked on attracting investments in liquefied natural gas (LNG). In 2012, Bahrain decided to construct an LNG import facility to supplement natural gas supply. In 2015, it signed an agreement on a LNG Terminal Construction and Operation Project with a consortium composed of the Canadian company Teekya LNG Partners (Teekay LNG), the Korean company Samasung C&T and of the Kuwait-based Gulf Investment Corporation (GIC). In 2016, the project received a loan of $741 million to be implemented. This project is going to be built on a floating gas terminal off the northeast coast of Bahrain as a limited liability company, and is being mainly developed to meet local needs for energy production in peak periods. In addition, Russian Gasprom is investing in an LNG plant in Bahrain aiming at turning the island into an LNG hub to supply the region with gas. The terminal is being currently constructed at the cost of $600 million and is planned to be commissioned in 2018.

In 2016, the Bahraini company Tatweer Petroleum signed a US$ 100 million contract with the British company Petrofac to construct a gas dehydration facility with a capacity of 500 mio standard cubic feet per day. This facility is expected to meet the growing demand for gas in Bahrain. In addition, Banagas is also planning to develop an associated gas plant. It has published tenders for engineering, procurement, construction and commissioning of the project to 3 international companies. Furthermore, Bahrain’s NOGA has issued tender to explore deep gas.

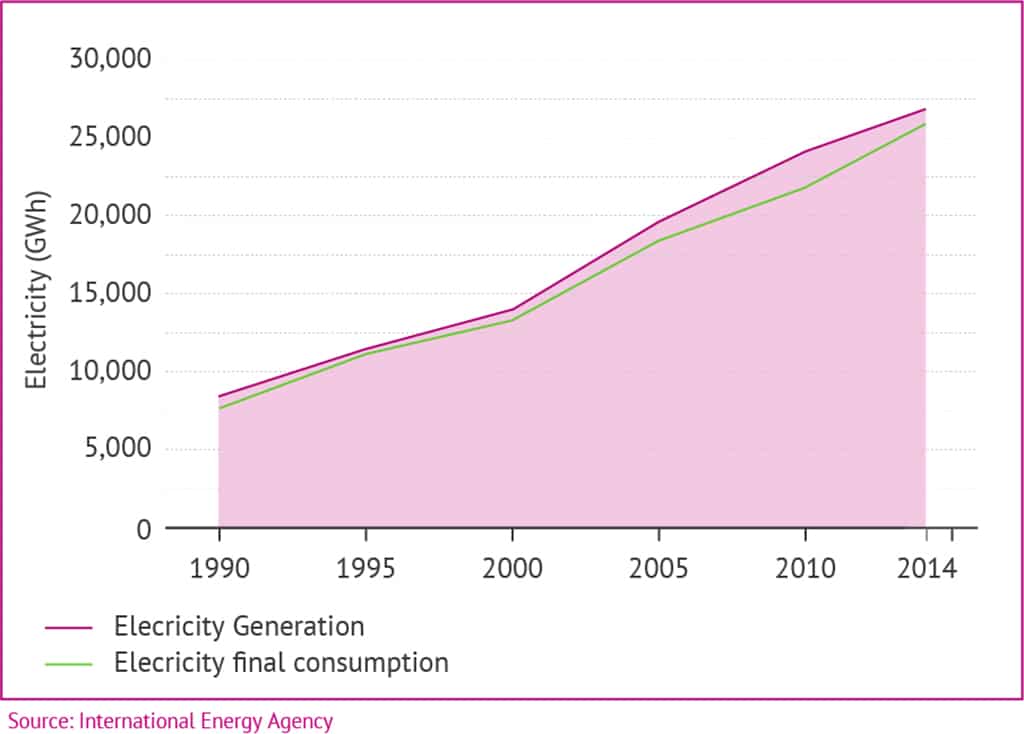

Electricity

Bahrain has generation capacity of 3,150 megawatts (MW). That is virtually all from thermal, oil or gas-fired power plants. 83% of its energy comes from natural gas and 17% from oil. There are five power plants in Bahrain, with two of the largest being public-private partnerships (PPPs), namely, Al Ezzel IPP (independent power producer), which has a capacity of 946 MW, and the Al Hidd IWPP (integrated water and power plant), which contributes around 1,006 MW to the grid. The transmission and distribution system comprises of 11 (33 kV) substations, 93 (66 kV) substations and 15 (220 kV) substations.

Under the GCC’s grid interconnection program, Bahrain is already connected to Saudi Arabia, Qatar, and Kuwait, and is able to receive as much as 600 MW of additional power capacity. The sector’s generation, transmission, and distribution is managed by the governmental agency Electricity & Water Authority (EWA).

Electricity in Bahrain is heavily subsidised. Already in 2013, it cost the state about $935 million. Electricity demand was 13.76 billion kilowatt/hours in 2010. A demand growth of 7% per year is expected through 2020. According to the World Bank, energy demand in Bahrain will reach 19,704 GwH. This soaring growth is driven by national housing programmes, rapid population growth and the growing demand for the industrial sector, especially in aluminum smelters.

In 2013, Bahrain was confronted with serious challenges of power outages. It managed to reduce the threat by more than 27% in 2013 but the country had to work on its energy infrastructure by improving reliance and consumptions culture. To achieve this goal, both energy efficiency and energy mix were boosted by increasing the share of renewable energy.

To fully solve this issue, EWA started in 2015 to work on a vast upgrade of the 220-KV electrical transmission network, as well as an expansion of power generation capacity. While most of the new megawatts will come from the Al Dur phase two expansion, the EWA is also developing smaller-scale solar and waste-driven power generation plants to diversify the country’s energy mix. Al Dur phase two will add 1200-1500 MW. In addition, three new power plants in Al Hadd, Umm Al Hassam and Al Rafah will be developed between 2016 and 2019.

Furthermore, EWA is rolling out a smart metering project with remote reading systems aiming at improving the timely reading of power consumption and boost energy efficiency.

Renewable Energy

There are currently only three wind turbines installed at the Bahrain World Trade Centre, as a symbol. However, in 2010, the Bahrain has set a target to create a minimum of 5% of its total electricity generation from renewable energy sources by 2030. EWA is planning to contract a 3-5 MW project combining solar and wind power. In addition, a 5 MW solar project is being developed at the University of Bahrain. The project will cost $30 million and is a joint venture between NOGA, the Bahrain Petroleum Company and few other American companies such as Caspian Energy Holdings and Petra Solar. However, current efforts are minor compared to the potential of Bahrain to generate 22 TWh per year from solar energy. In addition, Bahrain is working currently on the Askar Waste to Energy project, a plant which will incinerate solid waste to generate power.This plant will cost $480 million and will treat 390,000 tonnes of solid waste, generating 25 MW.

In 2008, Bahrain adopted the Economic Vision 2030. This policy document foresees the development of new energy regulations to reduce carbon emissions. Being part of the Small Island Nations Group in the international climate change negotiations, Bahrain took several measures reduce carbon emissions and worked with various international partners. Bahrain’s Economic Vision 2030 foresees the development of new energy regulations to reduce carbon emissions including new national standards for energy efficiency building, lightening and appliances. To achieve these objectives, Bahrain signed in 2013 an agreement with the World Bank to work jointly on energy efficiency issues. A joint working group was formed to study various areas such as efficient use of air conditioning, water and energy uses, as well as pollution and waste disposal.

Bahrain is also working with the UN Development Programme to develop a National Energy Conservation and Planning Center. This center is very likely to start operating in the near future.