Introduction

The Arab Republic of Egypt is the most populous Arabic-speaking country and the most populous country in the Middle East and North Africa (MENA) region. It has a large and fairly diversified economy, in which energy plays an important role. Given the huge population (96 million), energy exports have played a relatively small part in the economy compared to the countries of the Persian Gulf. Although it was a net energy exporter before the 2011 revolution, Egypt has relied on generous petroleum imports from the Gulf since 2013 and started to import liquefied natural gas (LNG) to meet demand in 2015. However, new and major gas discoveries since 2015 have allowed Egypt to limit LNG imports in 2017, and have raised hopes that Egypt will become a net gas exporter again from 2019.

Domestic energy consumption is substantial (and subsidized), although lower per capita than some of the richer oil-exporting states in the region, and the electrification rate is the highest in Africa.

Thanks to its location between the Mediterranean and the Red Sea, and its control of the Suez Canal, Egypt also plays an important role in energy transport.

About 2.97 million barrels per day (mb/d) of petroleum (crude and products) transited the Suez Canal in 2012, and 42.5 billion cubic meters (bcm) of LNG. This accounted for 7 per cent of total seaborne trade of petroleum and 13 per cent of LNG traded worldwide. The Sumed Pipeline, which has a capacity of 2.5 mb/d, allows crude oil to transit from the Red Sea’s Gulf of Suez to the Mediterranean from ships too large to go through the Suez Canal. Transit fees on the canal and pipeline are an important source of revenue for the government.

Egypt has experienced great upheaval since 2011, with long-time president Hosni Mubarak forced out by public demonstrations that were part of the Arab Spring uprisings, and subsequent political unrest that culminated in the overthrow of the Muslim Brotherhood by army general and current president Abdel Fattah al-Sisi. Egypt has not suffered the energy infrastructure damage that Libya, Yemen and other countries have, but the Arab Gas Pipeline that eventually feeds into a connector pipeline to Israel has been attacked numerous times by jihadist groups in the Sinai Peninsula, harming Egypt’s exports.

Oil

According to the Oil and Gas Journal’s January 2015 estimate, Egypt’s proven oil reserves stand at 4.4 billion barrels. This is small compared to the largest Gulf and North African producers but still quite large by global standards.

Egyptian oil production comes from five main areas: primarily the Gulf of Suez and the Nile Delta but also the Western Desert, the Eastern Desert and the Mediterranean Sea. Most production is derived from mature, relatively small fields that are connected to larger regional production systems. Production has been mostly declining in the past decades. In 2016, production stood at 544,000 barrels per day (bpd), up from 530,000 bpd in 2011, according to OPEC figures.

The Egyptian General Petroleum Corporation (EGPC) is the state entity charged with managing upstream activities including infrastructure, licencing and production. International and foreign national oil companies play a significant role in Egypt’s upstream sector on a production-sharing basis with EGPC. The energy sector is broken up into three holding companies in addition to EGPC and the Egyptian Mineral Resource Authority (EMRA): the Egyptian Natural Gas Holding Company (EGAS), the Egyptian Petrochemicals Holding Company (ECHEM) and Ganoub el Wadi Petroleum Holding Company (GANOPE).

For several years, new developments in the upstream petroleum (and gas) sectors have been slow as international oil companies were holding back investments in anticipation of the government paying its arrears, which in 2014 exceeded $6 billion. Since the Egyptian pound (EGP) was floated in November 2016, and the country’s liquidity improved thanks to international loans that ran into the billions, Egypt has been able to start repaying these companies, which have subsequently increased investments. Oil company debts have been reduced to $2.3 billion as of October 2017, and in the 2016-2017 fiscal year, oil investments have increased to $8.1 billion, up from $6.6 billion, Petroleum Minister Tarek al-Molla told the news agency Reuters.

The EGPC offer is diverse, although the largest single contingent of blocks comes from the prolific Western Desert, which stands out from the other areas as a continued growth region, with significant new discoveries still being made. With Egypt becoming a net importer of crude, the logic of licencing rounds and attracting investment has changed from maximizing the government take of a successful export business to one restricting the government cost of subsidizing imported fuels as much as possible. The smaller scale of discoveries has further incentivized the government to raise the frequency of licencing rounds and awards.

With regards to the downstream sector, the rise in consumption that is due in part to Egypt’s enormous and rising population (at 96 million by far the largest in the MENA region), as well as the continuing presence of subsidies, has meant that the country has been a (small) net importer of oil since sometime in 2008.

As part of the reforms that were a condition of the $12 billion loan approved by the International Monetary Fund (IMF) in November 2016, Egypt has started to reduce and phase out subsidies, particularly on fuel and electricity. For example, 50 litres of gasoline – roughly a full tank for an average vehicle – that in 2013 cost about EGP 80, now costs EGP 250, These reforms have decreased the fuel subsidy bill by almost half from 2011, but in the 2017-2018 fiscal year subsidies will still amount to $8 billion.

Total consumption of petroleum products was estimated at 797,000 bpd in 2014. Aided by increased domestic production, Egypt hopes to cut fuel imports to only 10 per cent of its consumption by 2019.

Egypt has a large amount of refining capacity, at 726,000 bpd crude oil throughput at nine refineries. However, total production of refined products reached 547,800 bpd in 2013, according to the CIA World Factbook. The largest is the Mostorod refinery in Cairo, with a capacity of 142,000 bpd. Egypt has been upgrading its existing refinery capacity and building new ones. The Egyptian Refinery Company is developing a new refinery with a capacity of 85,000 bpd, which is planned to start operation in 2018, after the initial completion date of 2016 was delayed. An upgrade of the Midor refinery in Alexandria from 115,000 bpd to 175,000 bpd is in progress. The Assiut refinery has also gone through several phases of upgrades and is set to start production in 2020.

Natural Gas

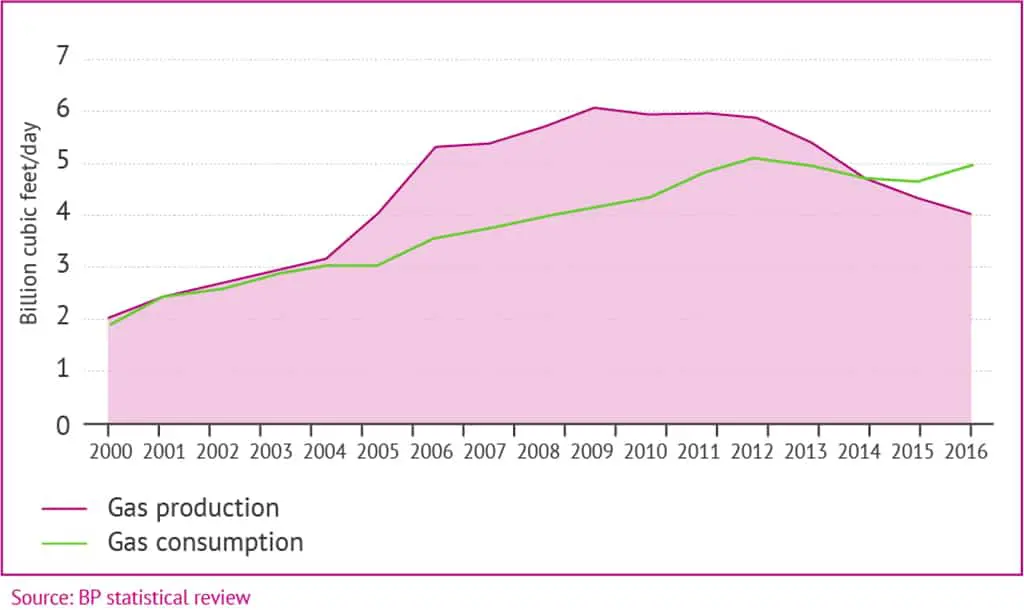

Major gas discoveries since 2015, most notably the ‘supergiant’ Zohr field in the Mediterranean, have had a major impact on Egypt’s financial and economic prospects. In the previous decade, Egypt greatly increased LNG production and built LNG terminals for export. The 2011 upheaval and subsequent economic crisis disrupted these export plans and forced Egypt to import expensive LNG shipments, putting an additional strain on its financial resources. The new gas discoveries have changed the equation. Egypt has started to limit the import of LNG and hopes to break even by early 2019. In the years beyond, it aspires to start exporting again.

The discovery of Zohr, which is being developed by Italy’s Eni company, was announced in August 2015. The field is expected to start producing by the end of 2017 and could hold up to 850 billion cubic metres (BCM) of gas.

Another major project is BP’s development of the Atoll field in the North Damietta Offshore Concession in the offshore East Nile Delta. It is estimated to hold 42 million cubic metres (MCM) of natural and 31 million barrels of condensates, and is projected to start production in 2018. BP has also started production in the West Nile Delta, where it is developing an estimated 140 MCM of gas and 55 million barrels of condensates.

Furthermore, BP made its third significant discovery in the North Damietta Offshore Concession in March 2017. Other developments include Shell’s discovery of an estimated 14 BCM of gas in the Western Desert in August 2016; and Eni’s discoveries in 2015 and 2016 in the Nooros field area of an estimated 60-70 MCM.

Egypt’s proven natural gas reserves are estimated at 2.19 TCM, the fourth largest in Africa after Nigeria, Algeria and Mozambique. These are significantly smaller than the countries of the Persian Gulf, with the exception of Kuwait and, of course, Bahrain, but they have greatly increased over the past 20 years as a result of the development of natural gas reserves in the Nile Delta as well as offshore in the Mediterranean including in deep water.

The improved financial situation in the country appears to have encouraged companies to explore for gas and oil in Egypt. In December 2016, six bids worth $200 million were accepted, while in August 2017 exploration deals worth a total of $160 million for fields in the Western Desert with Shell, Apex, Apache and Merlon were signed.

As in the oil sector, EGPC is the state entity charged with managing upstream activities including infrastructure, licencing and production. The promotion of the sector along with the development strategy is managed by EGAS. Both EGPC and EGAS work with private companies in joint venture partnerships.

Egypt has mostly used production-sharing agreements for foreign investment. In 2017, the government approved a new Natural Gas Act, setting up a gas regulatory body and privatizing the gas market in order to attract more investments.

The majority of natural gas in Egypt is used for electricity generation, with the next largest share for industry/petrochemicals. As per mid-2016, Egypt produced around 110 MCM per day and imported a further 30 MCM per day.

In 2010, Egypt still exported over 15 BCM, through the pipeline to Jordan and two LNG liquefaction and export facilities. The first LNG export facility to open was the single-train SEGAS (Unión Fenosa, EGAS, EGPC), at Damietta on the Mediterranean. It came online in December 2004 and has a capacity of 5.5 million tonnes per year.

Egyptian LNG (EGAS, EGPC, BG Group, Petronas and Gaz de France) at Idku on the Mediterranean has two trains, the first of which came online in September 2005, that have an export capacity of 3.6 million tonnes per year each.

Now that Egypt is importing instead of exporting, it rents two floating storage and regasification units (FSRUs) to convert imported LNG from liquid into gas.

The Arab Gas Pipeline was attacked multiple times in 2011 and 2012 by jihadist groups, most notably Ansar Beit al-Maqdis, which later pledged alliance to the Islamic State group. Following the pipeline’s closure in 2012, Israel brought an international arbitration case against Egypt, resulting in a $2 billion fine for the latter as a result of its failure to uphold its export agreement.

However, Israel and Egypt may have a mutual interest in gas relations. Israel aims to export natural gas from its major offshore Leviathan field but lacks export facilities. There has been a lot of talk about Egypt becoming a regional energy hub, re-exporting gas from Israel and Cyprus through its LNG terminals.

Coal

Egypt has one small coal mine, the Maghara mine in the Sinai Peninsula. Production is reported to be around 360,000 tonnes per year (although some sources show far lower figures). Production at Maghara, which is non-coking, contributes to a blend with imported metallurgical coal and is used for industrial processes.

In 2014, laws were amended to allow the use of coal in factories, in particular in the cement and steel industries and in power plants, in response to a structural shortage of power in the peak summer months. Large cement companies such as Lafarge and Italicementi have since started using coal to run their factories in Egypt. As a result, the country now imports 6 million tonnes of coal per year, according to media reports. In 2010, coal consumption stood at a little over 900,000 tonnes, then primarily used in the Helwan steel factory complex.

Egypt has signed several memoranda to build coal-fired power plants, with officials saying the country plans to generate 25-30 per cent of its electricity from coal. However, the status of these projects is unclear. In October 2017, the Ministry of Electricity and Energy delayed bidding for the construction of the planned $8 billion Hamrawein plant on the Red Sea, even though it aims to sign contracts by late 2018 and complete the plant in 2025. Another planned coal plant in South Sinai is also at an impasse over power purchase prices between the ministry and the contractor, the United Arab Emirates’ al-Nowais.

Electricity

Egypt is the third-largest consumer of electricity in the Middle East, after Saudi Arabia and Iran (not including Turkey). It also has the highest percentage of household access to electricity in Africa, above even South Africa. In May 2015, electricity generation capacity reached 31.45 gigawatts (GW), a significant increase compared to 23.5 GW in 2009. Some 70 per cent is fuelled by natural gas, 9.5 per cent by hydropower primarily from the Aswan High Dam and the remainder from petroleum and a small amount of renewable solar and wind power.

In the summer of 2013 and 2014, Egypt experienced severe blackouts when consumption exceeded production. In response, the government drew up a plan to add 30 GW of capacity by 2020. In 2015, the government signed a €8 billion deal with Siemens to build three natural gas-fired combined-cycle power plants with a capacity of 4.8 GW each. The first plant was connected to the grid in early 2017, and by May 2018 all three power plants are due to be completed, increasing Egypt’s total capacity by 45 per cent.

The Ministry of Electricity and Energy (MoEE) is the principal state entity in the electricity sector. A number of authorities and state-owned companies report to the MoEE including the Egyptian Electricity Holding Company (EEHC), New and Renewable Energy Agency (NREA), Rural Electrification Authority, Hydropower Projects Authority and nuclear energy agencies. EEHC in turn owns major generating companies such as the Cairo Electricity Production Company (CEPC). EEHC has been unbundled but operates as a tightly controlled holding company, with the holding company exerting significant influence over its subsidiaries in financial and governance matters. EEHC still has strong links to the government, through subsidies, facilitation of investment financing, fuel prices and electricity tariff regulation.

There are plans to expand solar and wind power in Egypt. The EEHC entered into an agreement with Solar Millenium and Orascom Construction to build the first solar thermal power plant at al-Kuraymat in 2010. The plant started operation in June 2011 and has an installed capacity of 140 MW and a yearly energy of 852 gigawatt-hours (GWh).

In 2015, NREA started a large solar project in Benban, north of Aswan, consisting of 41 plants with a total capacity of 1.8 GW. The project is due for completion in 2018. Despite this being one of the largest solar power parks in the world, the implementation of solar power in Egypt has faced challenges. In 2016, a larger solar power feed-in tariff (FiT) scheme with over 40 companies involved largely failed after the government made last-minute changes to the power purchase agreement, forcing companies to withdraw. A second FiT scheme is also facing issues over contract disagreements. Due to the difficulties of dealing with the government, some companies target the off-grid market, but this constitutes only smaller scale solar projects.

Conditions for wind power are particular good along the Red Sea coast. Wind parks in Egypt include the 545 MW Zafarana, south of Ain Sokhna on the Gulf of Suez. Another 540 MW project is under construction in the same area, while a further 1,000 MW in different projects are still in the pipeline.

Egypt is also working on developing nuclear power. In November 2015, it signed an agreement with Russia’s Rosatom to build a 1.2 GW nuclear power plant in Dabaa, in the Matrhouh governorate on the Mediterranean coast. According to the agreement, Russia will provide a $25 billion loan to finance the plant, which Egypt will have to repay over a period of 35 years. The completion date was at first reported to be 2022. However, in late 2017 the contracts for the plant construction had not yet been finalized, so a completion date between 2025 and 2030 seems more realistic.

Egypt is planning to construct an electricity linkage with Saudi Arabia underneath the Red Sea, to be operational in 2019. This would be advantageous given that peak demand is often at noon in Saudi Arabia but in the evening in Egypt. Egypt has submitted a tender for companies to compete for cables and transformers, but a decision has repeatedly been delayed. Egypt already has a link to Jordan and onward to Syria and Turkey as well as with Libya to the west. Egypt exported about 900 million kWh (net) in 2008.