Introduction

The Hashemite Kingdom of Jordan is one of the most hydrocarbon-poor countries in the Middle East, with neither significant production of oil or natural gas. It relies heavily on imported oil and gas for power generation, and is currently implementing various renewable energy projects.

It does, however, have large reserves of oil shale, but these have yet to be developed and there are several challenges associated with their development.

The economy is focused on expanding the export manufacturing sectors and tourism, although attracting investment in the energy sector is increasingly important. Unemployment is widespread, but the country has achieved a fairly high level of economic development.

In May 2011, Jordan requested membership in the Gulf Cooperation Council (GCC). Its application is currently under consideration.

Oil

Production of crude oil is negligible, and conventional oil reserves are insignificant – estimated at just 1 million barrels. Consequently, Jordan imports nearly all of its oil, at an average of 2.5 million barrels a month from Saudi Arabia and 15,000 subsidized barrels a day (bbl/d) from Iraq. This is in addition to 30 tons per month of subsidized heavy fuel oil, also from Iraq, for use in power plants. It is expected that by 2020, the average annual energy demand will grow by about 5.5 per cent. Crude oil imports from Iraq are currently delivered by truck, but Jordan has initiated discussions regarding the construction of a crude oil pipeline to carry these imports instead. In 2013, Jordan and Iraq signed an agreement to construct an oil pipeline from Iraq’s Basra fields to the Jordanian port of Aqaba. However, this project has been delayed due to security concerns in Iraq.

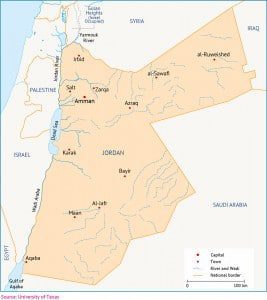

The Jordan Petroleum Refinery Company operates the kingdom’s sole refinery at Zarqa. It has a throughput capacity of 65,000bbl/d. Besides Iraq, crude oil and product imports are sourced from Saudi Arabia, Kuwait and the United Arab Emirates. The general instability in the region, mainly the wars in Iraq and Syria, have made it difficult for Jordan to attract foreign investors to upgrade its refinery.

Another area of substantial potential is shale oil. Jordan’s Natural Resources Authority (NRA) estimates that shale oil reserves amount to over 500 billion barrels of crude oil-equivalent volumes. Important oil shale deposits include the large Attarat Um Ghudran, Jurf Ed Darawish and Wadi Maghar; and the smaller al-Lajjun and Sultani deposits. Jordan’s oil shale is noteworthy for being very high in sulphur (8-10 per cent), which will incur additional expense to extract usable oil. Shale oil can be burned directly to generate electricity or further processed into synthetic crude oil for refining. Some important investments in the sector include:

Enefit (part of Eesti Energia of Estonia) plans to invest $1.8 billion in Attarat Um Ghudran, with the aim of producing 40,000bbl/d of shale oil from the deposit by the end of 2018.

Jordan Oil Shale (part of Royal Dutch Shell) plans to invest as much as $500 million in a concession covering 22,000km2 in the Azraq and al-Jafr blocks. The aim is to evaluate the viability (economic and geological) of fairly large-scale production, with actual commercial production not to commence until after 2020.

Karak International Oil (a subsidiary of the British Jordan Energy and Mining Ltd) has a 35km2 concession in al-Lajjun. The company expects to produce 360 barrels of shale oil per day by sometime in 2016, with the possibility of reaching 60,000 tons per year with additional investment.

There are at least five other smaller investments. In addition, a number of initiatives are being developed with Chinese and Estonian companies to construct power plants that utilize oil shale. Overall, the Jordanian government hopes to get 14 per cent of its energy from indigenous deposits of oil shale resources by 2020.

However, the various processes for extracting shale oil from oil shale, all of which involve heating the oil shale to extract hydrocarbon vapours, cost as much as $50 per barrel, significantly more expensive than producing conventional reserves, particularly compared to the low per-barrel costs enjoyed by Jordan’s neighbours such as Iraq and Saudi Arabia.

However, given that today’s crude oil prices are around $50, well below $65 (the approximate price to ensure profitability), and expected to stay below this level in the coming few years, foreign companies are currently less inclined to invest in the shale oil sector in Jordan.

Natural Gas

Jordan consumed only limited amounts of natural gas until the inauguration of the Arish-Aqaba section of the Arab Gas Pipeline in 2003, which enabled Egypt to export gas to Jordan. Jordan imports about 6.8 million cubic metres per day (MCM/d) from Egypt, which represents about 83 per cent of consumption of slightly more than 3 billion cubic metres per year (BCM/yr).

These vital imports are used for gas-fired electricity generation plants which, in turn, provide 80 per cent of the country’s electricity. The government is preparing a gas masterplan to better incorporate this important energy source into the country’s economy in the future.

Jordan’s own natural gas reserves are more substantial than its conventional oil reserves, the former estimated at some 6BCM, according to Oil & Gas Journal. Most of that comes from the Risha field, which straddles Jordan’s border with Iraq. Risha’s output has declined to 566 thousand cubic metres per day, from a peak of 1,076MCM/d in 2003. The field still has substantial reserves, and needs new investment. Only 1,500km2 of a total of 7,000km2 have been fully explored.

In October 2009, BP concluded an agreement with Jordan’s National Petroleum Company to spend $237 million on exploration and appraisal over a three-year period. The first exploratory wells were drilled in 2011. With the information gathered at the end of the period, BP intended to confer with the National Petroleum Company. However, since the signing of the agreement with BP, Jordan has also reached an agreement with Iraq to develop the Risha field.

Thus, after BP finishes the initial phase, Jordan and Iraq are expected to consult the oil major before it is able to proceed to a planned $8-10 billion investment that would bring online at least 8.5MCM/d of production, if all goes to plan.

Bringing Risha online would also resolve a problem that has plagued Jordan’s imported gas supply, namely the continuing attacks on the Egyptian section of the pipeline that temporarily shut off supply. The fact that the Egyptian section also feeds into the Arish-Ashkelon Pipeline, which goes to Israel, and that security in Egypt has been affected by the 2011 revolution, have made the pipeline a particular target for militants, who attacked it six times in 2011 alone.

This interruption of supply has many macroeconomic implications, since power plants have to switch to the more expensive heavy fuel oil and diesel for power production. As a result, Jordan has had to increase its subsidy for oil products. Another possible alternative or addition to the Egyptian supply would be the construction of a liquefied natural gas (LNG) import and regasification facility at Aqaba. This possibility is still being explored by the Ministry of Energy and Natural Resources.

In addition, in September 2015 Jordan signed a memorandum of understanding with the US-based Nobel Energy, which is developing the Leviathan gas field in Israel. This agreement is planned to be implemented in 2017, but might experience some delays due to regulatory challenges in Israel. If it goes ahead, however, it will secure 30 per cent of Jordan’s electricity demand.

Electricity

Jordan’s actual electricity generation capacity is 3,050 megawatts (MW), mainly produced by burning imported oil and natural gas. Electricity consumption is about 2,800MW. It is expected that the annual growth rate for electricity will reach about 7.4 per cent by the year 2020. In response to the soaring demand, Jordan has increased the tariff by 20 per cent for all consumer categories.

Jordan’s electrical grid is linked to the grids of Egypt, Iraq, Libya, Lebanon, Palestine, Syria and Turkey as part of the Eight Countries Interconnection Projects. The aim of the projects is to share power across interconnected grids, thereby deferring, or avoiding altogether, the construction of new power plants.

The heavy reliance on imported oil and natural gas, combined with environmental damage, has encouraged Jordan to liberalize its energy sector, adopt energy-efficiency measures and boost the use of renewable energy.

The electricity sector is structured as follows: generation comes from four sources, the partially state-owned Central Electricity Generating Company (CEGCO); independent power producers (IPPs); a few large industries with their own generation capacity; and power imports. These four feed into one transmission grid, the state-owned National Electric Power Company (NEPCO).

From NEPCO, three distribution companies, Jordan Electric Power Company (JEPCO), Irbid District Electricity Company (IDCO) and Electricity Distribution Company (EDCO), distribute to consumers, with the exception of a few large industrial consumers who deal directly with NEPCO.

CEGCO’s conventional generating capacity is 1,706MW from ten power plants, plus a relatively small but growing amount of renewable power (2 per cent). Many plants were converted from heavy fuel oil to natural gas, which has had positive environmental effects, as has the conversion of the Rehab station to combined cycle (several IPP plants are also combined cycle). Jordan has one of the best potentials for renewable energy.

It has an average solar radiation of 5-7kWh/m2 per day and wind speeds of 7-11m/s. Nevertheless, so far only a limited number of projects have been developed. This is generally attributed to regulatory challenges, energy prices and the difficulties of attracting foreign investments. However, the strong involvement of the International Finance Cooperation (IFC) of the World Bank and many other international organizations, combined with the commitment of the Jordanian government, promise better results.

CEGCO operates wind turbines at its Hofa and Ibrahimiya plants, which generate about 2.9 gigawatt-hours per year (GWh/yr), and a 2.5 MW biogas facility (along with Amman municipality). Jordan is also considering bids to build a 90MW wind farm (Fujeij) in the south. Solar panels are to be installed on the Dead Sea Panorama Complex, to supply 876,500kW/hr by October. Approximately 13 per cent of Jordanian homes are equipped with solar panels. By 2015, 69MW of photovoltaic installations on individual rooftops had been finalized.

As part of its Energy Strategy 2007-2020, Jordan aims to have 10 per cent of its energy mix produced by renewables (1,200MW wind, 600MW solar and 20-30MW waste to energy) by 2020. So far, 34 proposals have been shortlisted for projects with a total capacity of 1,000MW.

Energy Minister Khaled Toukan announced in late September 2011 that the kingdom’s first nuclear reactor is scheduled to be operational in 2019. The facility is to add an additional 1,000MW to the country’s electricity generation capacity. The Jordan Atomic Energy Commission (JAEC) is currently reviewing financial bids from shortlisted vendors for the construction of a Generation III reactor in Majdal, some 40 kilometres northeast of Amman. The bidders are the Canadian AECL, Russian Atomstroy Export and a French-Japanese joint venture comprising Areva and Mitsubishi Heavy Industries.